U.S. Supreme Court and the Wayfair decision

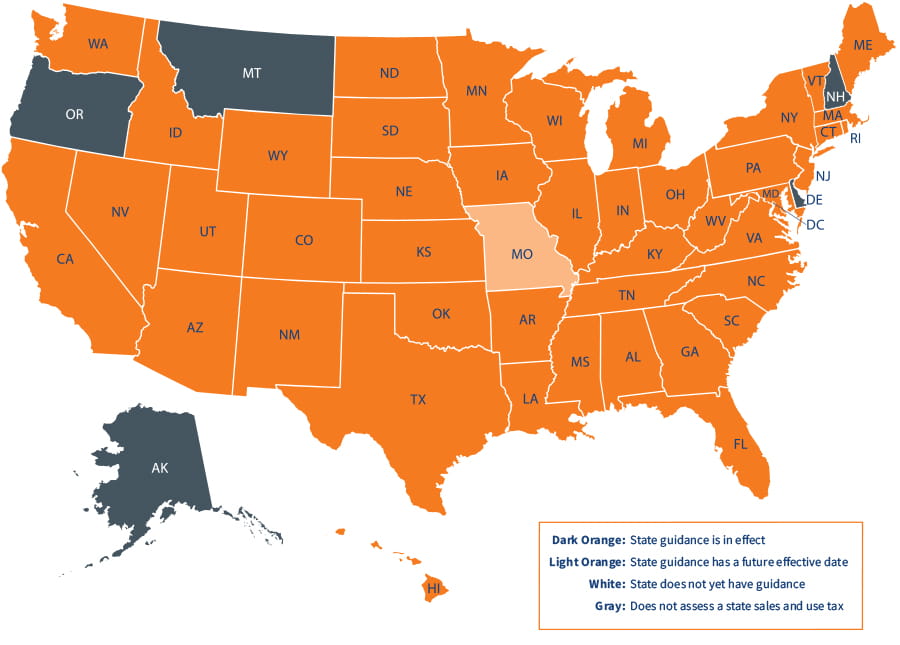

South Dakota v. Wayfair – State by State Guidance

On June 21, 2018, the United States Supreme Court issued its decision in South Dakota v. Wayfair, Inc., 585 U.S. __ (2018), dramatically changing the sales tax landscape for multi-state sellers. This decision had immediate – and significant – implications to any taxpayers making remote retail and wholesale sales of services or tangible property. Unfortunately, many multistate businesses are still not in compliance with State sales tax compliance rules and should take the time understand the implications for their business.

Things to consider

Over six years later, we are still seeing changes attached to this decision. We are also seeing a new line of guidance from the states as to how they expect the Wayfair decision to be applied within their respective jurisdiction not just to sales tax but also to income/franchise and other state and local taxes. The information below is meant to assist businesses as they review current state and local requirements and continually work to adjust to the necessary changes to become and remain compliant. While this process may be straightforward in some states, others may require further clarification.

Filter:

- States

-

ALABAMAOver $250,000 in retail sales and enumerated activity per Ala. Code § 40-23-68 Ala. Admin. Code r. 810-6-2-.90.03(1); See also, ADOR Announces Sales and Use Tax Guidance for Online Sellers, issued by the Alabama Dept. of Revenue (7/3/2018)..

Alabama Administrative Code r. 810-602.90.03(1)

Enforcement Date: 10/01/2018 -

ALASKAAlaska does not assess a state sales and use tax.

-

ARIZONAGross income derived from sales exceeding $200,000 in 2019, $150,000 in calendar year 2020; and $100,000 in calendar year 2021 and subsequent years. Ch 273 (H.B. 2757), Laws 2019, effective 08/27/2019, and applicable as noted; News Release, Arizona Dept of Revenue, 05/31/2019.

Enforcement Date: 10/01/2019 -

ARKANSAS$100,000 in aggregate sales or 200 transactions in the current or prior calendar year

Act 822 (S.B. 576), Laws 2019

Enforcement Date: 07/01/2019 -

CALIFORNIAOver $500,000 gross sales during the current or prior calendar year. Additionally, all retailers (in and outside California) are required to collect and pay to the CDTFA district use tax on all sales made for delivery in any district that imposes a district use tax if in the preceding or current calendar year the total combined sales of TPP in the state or for delivery in the state exceed $500,000.

A.B. No. 147; L.2019, A147 (c.5); Cal. Rev. & Tax Code 7262

Enforcement Date: 04/01/2019 -

COLORADOOver $100,000 in gross revenue during the current or prior calendar year; or 200 or more separate transactions during the current or prior calendar year.

Colo. Code Regs. 39-26-204.2(1)(b)(I)(II)

Enforcement Date: 12/01/2018 with a grace period until 06/01/2019 -

CONNECTICUTEffective 07/01/2019, out-of-state retailers that make retail sales of tangible personal property or services from outside Connecticut to a destination within Connecticut must collect and remit sales or use tax if they made at least 200 Connecticut sales during the preceding 12-month period ending Sept. 30; and their gross receipts are $100,000 or more during that period.

Formerly, such retailers were obligated to collect and remit sales tax if they made at least 200 Connecticut sales during the 12-month period and their gross receipts were $250,000 or more during that period.

The newly enacted provision lowers the threshold to 200 transactions and $100,000 in gross receipts during the 12-month period; expands it to apply to out-of-state retailers making retails sales of services, as opposed to just tangible personal property; and eliminates the condition that such retailers be regularly or systematically soliciting sales in Connecticut. Conn. Gen. Stat. §12-407; L. 2019, H7424 (P.A. 19-117)

Enforcement Date: 07/01/2019 -

DELAWAREDelaware does not assess a state sales and use tax.

-

DISTRICT OF COLUMBIAOver $100,000 of gross receipts from retail sales during the current or prior calendar year or more than 200 separate retail sales transactions during the current or prior calendar year D.C ACT 22-556 (12/31/2018); OTR Notice 2019-02 (01/02/2019)

Enforcement Date: 01/01/2019 -

FLORIDAGross sales in excess of $100,000 during the prior calendar year. SB 50; Fla. Stat. §§ 212.02, 212.05, 212.054, 212.0596

Enforcement Date: 07/01/2021 -

GEORGIACurrent Rule: Over $100,00 in gross revenue in the previous or current calendar year or 200 or more separate retail transactions in the previous or current calendar year. H.B. 182

Prior Rule: Over $250,000 in gross revenue in the previous or current calendar year or 200 or more separate retail transactions in the previous or current calendar year. If the remote seller chooses not to collect and remit sales tax, on 1/1/2019, the seller must notify each potential purchaser immediately prior to the completion of each retail sale transaction that sales/use tax may be due. On/before 1/31/2020, and each year thereafter, the seller must send a sales/use tax statement to the purchaser who completed one or more retail sales totaling $500 or more in aggregate during the prior calendar year; and also on/before 1/31/2020, must file a copy of the same notice with the state.

GA Code Ann. §§ 48-8-2(M.1, M.2); 48-8-30(c.1, c.2); GA DOR Policy Bulletin SUT-2018-07 (10/1/2018)

The Notice and Reporting rule cited above was repealed effectie 4/28/2019.

Current Rule Enforcement Date: 01/01/2020

Prior Rule Enforcement Date: 01/01/2019 -

HAWAIIOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Hawaii State Legislature Act 41 (S.B. 2514)

Enforcement Date: 07/01/2018 -

IDAHOOver $100,000 in gross receipts in the current or prior calendar year.

L. 2019, H259.

Enforcement Date: 06/01/2019 -

ILLINOIS$100,000 or more gross sales or 200 or more transactions in four (4) prior quarters.

Illinois Public Act 100-0587

Enforcement Date: 10/01/2018 -

INDIANAOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Indiana Code § 6-2.5-2-1(c)

Enforcement Date: 10/01/2018 -

IOWAOver $100,000 gross sales in the current or prior calendar year.

Iowa Code 423.14A(3)(d)(1)

Enforcement Date: 07/01/2019

From 01/01/2019 - 06/30/2019, over $100,000 gross sales in the during current or prior calendar year or 200 separate transactions during the current or prior calendar year.

Enforcement Date: 07/01/2019 -

KANSASEffective 7/1/2021, remote sellers will be required to register to collect/remit sales tax if, in the current or immediately preceding calendar year, the remote seller has more than $100,000 of cumulative gross receipts from sales to Kansas customers.

S.B. 50, Laws 2021

From 8/1/2019 - 6/30/2021, Kansas imposed its sales and use tax collection requirements to the fullest extent permitted by law. Specifically, …, K.S.A. § 79-3702(h)(1)(F) provides that a retailer doing business in Kansas means: (F) any retailer who has any other contact with [Kansas] that would allow [Kansas] to require the retailer to collect and remit tax under the provisions of the constitution of the laws of the United States.

Kansas can, and does, require online and other remote sellers with no physical presence in Kansas to collect and remit the applicable sales or use tax on sales delivered into Kansas. Accordingly, a remote seller must register with Kansas and obtain a sales and/or use tax account number.

Kansas Notice 19-14 (8/1/2019)

Current Rule Enforcement Date: 07/01/2021

Prior Rule Enforcement Date: 08/01/2019 -

KENTUCKYOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Kentucky Department of Revenue HB 487

Enforcement Date: 10/01/2018 -

LOUISIANAOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Louisiana Remote Sellers Information Bulletin 18-001 (08/10/2018)

Enforcement Date: 01/01/2019 -

MAINEOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Maine Revised Statutes Annotated § 1951-B

Enforcement Date: 07/01/2018 -

MARYLANDOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Maryland Code Regulations § 03.06.01.33x

Enforcement Date: 10/01/2018 -

MASSACHUSETTSOver $100,000 gross sales in the current or prior calendar year. (Enacted 8/1/2019 - H. 4000, Laws 2019, effective October 1, 2019)

From 10/1/2017 - 9/30/2019 the rule was over $500,000 in gross sales during the preceding calendar year from transactions completed over the internet and made sales resulting in a delivery into Massachusetts in 100 or more transactions. 830 CMR 64H.1.7(3)

Enforcement Date: 10/01/2019 -

MICHIGANOver $100,000 gross sales in the previous calendar year or more than 200 transactions in the previous calendar year.

Michigan Revenue Administrative Bulletin 2018-16 (08/01/2018)

Enforcement Date: 10/01/2018 -

MINNESOTAOver $100,000 in retail sales in 10 or more transactions or 100 or more retail transactions.

MN Dept. of Rev. News Release (07/25/2018)

Enforcement Date: 10/01/2018

Effective after 09/30/2019: Retail sales totalling more than $100,000 during the prior 12-month period; or 200 or more retail sales during the prior 12-month period. Ch. 6 (H.F. 5), First Special Session, Laws 2019, effective 05/30/2019, except as noted

Enforcement Date: 10/01/2019 -

MISSISSIPPIOver $250,000 in gross sales for the last 12-months and exploitation of the Mississippi market.

Mississippi Code R. § 35.IV.3.09.100, .101

Enforcement Date: 09/01/2018 -

MISSOURI$100,000 in cumulative gross receipts in a twelve-month period.

Missouri SB 153 & 97.

Enforcement Date: 01/01/2023 -

MONTANAMontana does not assess a state sales and use tax.

-

NEBRASKAOver $100,000 in sales or 200 or more retail transactions annually.

Nebraska DOR: Notice for Remote Sellers and Marketplace Facilitators.

Enforcement Date: 04/01/2019 -

NEVADAOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

LCB File No R189-18

Enforcement Date: 10/01/2018 -

NEW HAMPSHIRENew Hampshire does not assess a state sales and use tax.

-

NEW JERSEYOver $100,000 gross sales during the current or prior calendar year or 200 or more transactions during the current or prior calendar year.

Notice, Sales and Use Tax Information for Remote Sellers, NJ Division of Taxation

Enforcement Date: 11/01/2018 -

NEW MEXICOAt least $100,000 in gross sales during the prior calendar year.

2019 NM H 6, Adopted

Enforcement Date: 07/01/2019 -

NEW YORKCurrent Rule: Greater than $500,000 in sales of tangible personal property delivered in state and conducted more than 100 sales of tangible personal property delivered in state in the immediately preceding four sales tax quarters. The sales tax quarters are Mar. 1 through May 31, Jun. 1 through Aug. 31, Sept. 1 through Nov. 30, and Dec. 1 through Feb. 28/29. N.Y. Tax Law §§ 1101(b)(8)(i)(E), 1101(b)(8)(iv); see also, New York Department of Taxation and Finance Notice N-19-1 (1/15/2019)

Prior Rule: Prior to 7/1/2019 the dollar threshold was $300,000 and more than 100 sales of tangible personal property delivered in state in the immediately preceding four (4) sales tax quarters.

Prior Rule Enforcement Date: 06/21/2018

Revised Rule Enforcement Date: 07/01/2019 -

NORTH CAROLINAOver $100,000 gross sales in the previous or current calendar year or 200 or more transactions in the previous or current calendar year.

Ch. 6 (S.B. 56), Laws 2019, effective 03/20/2019

Enforcement Date: 11/01/2018 -

NORTH DAKOTAOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

North Dakota Century Code §§ 57-39.2-02.2; 57-40.2-02.3

Enforcement Date: 10/01/2018 -

OHIOOver $100,000 gross sales in the previous or current calendar year or 200 or more transactions in the previous or current calendar year. Ohio Rev. Code Ann. § 5741.01(S) and 5741.17(c)

From 1/1/2018 - 7/31/2019, the rule was over $500,000 gross sales during the current or preceding calendar year through in-state software. Ohio Rev. Code Ann. § 5741.01

Enforcement Date: 08/01/2019 -

OKLAHOMAEffective 11/1/2019, the threshold increases to $100,000 in gross sales during the preceding or current calendar year and a remote seller are no longer allowed to make an election to comply with notice reporting requirements.

L. 2019, S513

Prior Rule: Over $10,000 in aggregate OK sales in prior 12 month calendar period (collect or comply with notice and reporting requirements)

State law HB1019xx; Remote Seller Info & FAQs

Prior Rule Enforcement Date: 07/01/2018

Revised Rule Enforcement Date: 11/01/2019 -

OREGONOregon does not assess a state sales and use tax.

-

PENNSYLVANIA1. Elect to register or comply with notice & reporting requirements: A remote seller, marketplace facilitator or a referrer that had aggregate PA taxable sales of at least $10,000, but less than $100,000 during the previous 12-month period. (Election must be made by 03/01/2018 and each subsequent June 1st beginning 06/01/2019). Pennsylvania Sales & Use Tax Bulletin 2019-01 (Issued 01/08/2019; revised 01/11/2019)

Enforcement Date: 04/01/2018

2. Must register to collect sales tax: A remote seller, marketplace facilitator or a referrer that had aggregate PA taxable sales greater than $100,000 over the previous 12-month period. Pennsylvania Sales & Use Tax Bulletin 2019-01 (Issued 01/08/2019; revised 01/11/2019; effective 07/01/2019)

Enforcement Date: 07/01/2019

Notice and reporting requirements were not necessarily repealed; however if a remote seller now meets economic nexus in PA, the Act 43 notice provisions are no longer an option and thus, a remote seller MUST register and begin collecting sales/use tax. -

RHODE ISLANDGross revenue from the sale of tangible personal property, prewritten computer software delivered electronically or by load and leave, vendor-hosted prewritten computer software, and/or has taxable service delivered into Rhode Island equal to or exceeding $100,000; or has sold tangible personal property, prewritten computer software delivered electronically or by load and leave, vendor-hosted prewritten computer software, and/or taxable services for delivery into Rhode Island in 200 or more separate transactions. R.I. Gen. Laws §§ 44-18.2-2(4), 44-18.2-3; See also, L. 2019, S251; Rhode Island Advisory No. 2019-11, (5/24/2019) Rhode Island Advisory No. 0217-09 (4/4/2017)

Enforcement Date: 01/01/2019

Note: Rhode Island had a prior notice reporting rule that was enforcable on 8/1/2017. This rule was repealed in favor of the economic nexus rule stated above.

Prior Rule Enforcement Date: 08/17/2017

Revised Rule Enforcement Date: 07/01/2019 -

SOUTH CAROLINAOver $100,000 gross sales in the current or prior calendar year.

Revenue Ruling #18-14, South Carolina Department of Revenue (09/18/2018)

Enforcement Date: 11/01/2018 -

SOUTH DAKOTAOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

South Dakota Codified Laws §10-64-2

Enforcement Date: 11/01/2018 -

TENNESSEEOver $500,000 in gross sales and during the previous 12 month period and engage in the regular or systematic solicitation of consumers in Tennessee through any means. Remote sellers who meet the sales threshold as of 7/31/2019 must register and begin collecting sales/use tax by 10/1/2019. If a remote seller meets the $500,000 threshold after 7/31/2019, the remote seller is required to register and begin collecting sales/use tax on the first day of the third month in which it meets the threshold.

L.2019,H667; Tenn. Comp. R. & Regs. § 1320-05-01-.129(2); See also, Tennessee Sales Tax Notice No. 19-04 (6/1/2019)

The dollar threshold above is reduced to $100,000 effective 10/1/2020.; all else remains the same.

Tenn. Code Ann. § 67-6-543; (Ch. 759 (S.B. 2932), Laws 2020)

Prior Rule Enforcement Date: 10/01/2019

New Rule Enforcement Date: 10/01/2020 -

TEXAS$500,000 or greater of gross revenue in the preceding 12 calendar months. The initial 12 calendar months for determining a remote seller's total Texas revenue will be 07/1/2018 - 06/30/2019. If a remote seller's Texas revenue during this period exceeds $500,000 the seller must obtain a permit by 10/01/2019 and begin collecting use tax no later than 10/01/2019.

Adopted Rules - 43 TexReg 8133 (12/14/2018); 34 TAC 3.286

Enforcement Date: 10/01/2019 -

UTAHOver $100,000 in gross sales in either the previous or current calendar year or 200 or more separate transactions in the previous or current calendar year.

Utah Code Annotated §59-12-107(2)(c)(ii)

Enforcement Date: 01/01/2019 -

VERMONT$100,000 or more gross sales or 200 or more transactions during any 12-month period preceding the monthly period.

Vermont Statutes Annotated § 9701(9)(f)

Enforcement Date: 07/01/2018 -

VIRGINIAOver $100,000 in gross sales in either the previous or current calendar year or 200 or more separate transactions in the previous or current calendar year.

L. 2018, H1722 (c. 815), effective 07/01/2019; L. 2018, S1083 (c. 816) effective 07/01/2019; See also, Guidelines for Remote Sellers and Marketplace Facilitators, Virginia Department of Taxation, May 2019.

Enforcement Date: 07/01/2019 -

WASHINGTONEffective from 10/01/2018 through 12/31/2019 sellers are required to collect and remit sales tax if they have, in the current or immediately preceding calendar year, more than $100,000 of cumulative gross receipts from Washington, 200 or more separate transactions for the delivery of products into Washington or physical presence under Wash. Rev. Code § 82.04.067.

However, sellers subject to a sales and use tax collection requirement only because of the 200 transaction threshold are relieved of their collection obligation, effective 03/14/2019.

Effective 01/01/2020, sellers with greater than $100,000 of cumulative gross receipts; or subject to the limitation in RCW 82.32.531, physical presence in the state, which need only be demonstrably more than a slightest presence. Wash. Rev. Code § 82.04.067; RCW 82.32.531; News Release, Washington Department of Revenue, 03/18/2019

Enforcement Date: 10/01/2018 -

WEST VIRGINIADuring the previous tax year either delivered more than $100,000 of goods or services into West Virginia; or engaged in 200 or more separate transactions for the delivery of goods and services into West Virginia.

Administrative Notice 2018-18, West Virginia State Tax Department (10/01/2018)

Enforcement Date: 01/01/2019 -

WISCONSINOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Wisconsin Statute § 11.97(4)

Enforcement Date: 10/01/2018 -

WYOMINGOver $100,000 gross sales in the current or prior calendar year or 200 or more transactions in the current or prior calendar year.

Wyoming Statutes Annotated § 39-15-501

Enforcement Date: 02/01/2019

Suzanne Wilson

Director, National Tax - SALT

Close

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Receive CohnReznick insights and event invitations on topics relevant to your business and role.