Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

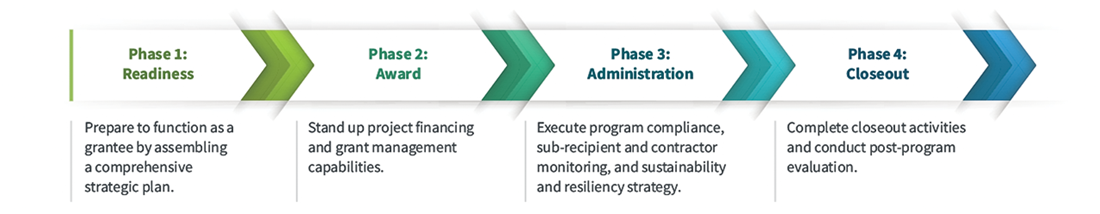

SOLUTIONS THROUGHOUT THE GGRF PROGRAM LIFECYCLE

Operating as a competition, the Greenhouse Gas Reduction Fund is allocated among three components:

In order to put GGRF capital to work quickly, it’s important that prime recipients move quickly to design their program for success throughout the GGRF lifecycle and develop the program administration, resources, and compliance solutions required. CohnReznick can help you:

WHY COHNREZNICK?

There are five reasons why CohnReznick is uniquely well-positioned to help GGRF prime- and sub-recipients achieve their strategic implementation and maximize the impact of their GGRF funding.

OUR SERVICE AREAS

GGRF program breakdown: NCIF VS. CCIA VS. SFA

The GGRF program is driving three competitions that strategically target investment:

-

Overview: The NCIF program provides funding to nonprofits to mobilize private capital to create clean financing instruments that fund tens of thousands of projects.

Prime recipients: 3 national nonprofits, announced in April 2024. Funding is expected to be available in July.

Investment amount: $14 billion

Priority project categories:

– Distributed energy generation and storage

– Net-zero emissions buildings

– Zero-emissions transportation

-

Overview: The CCIA program funds selected industry-focused hub nonprofit recipients to develop a network of community lenders to provide access to capital.

Prime recipients: 5 national nonprofits announced in April 2024.

Investment amount: $6 billion

Priority project categories:

– Distributed energy generation and storage

– Net-zero emissions buildings

– Zero-emissions transportation

-

Overview: The Solar For All program provides funding to drive solar development in low-income and disadvantaged communities throughout the U.S.

Prime recipients: 60 states, tribal governments, municipalities, and nonprofits announced in April 2024. Funding is expected to be available this summer.

Investment amount: $7 billion

Priority project categories:

– Residential rooftop solar

– Residential-serving community solar

– Associated storage

– Enabling upgrades

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.