Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Carve-outs and how they can benefit you as a seller

While the use of seller carve-outs can be a solid strategy for companies, there are also important considerations to be aware of.

In the world of business, carve-outs stand as a strategic option that allows companies to adapt, refocus, and prosper. A carve-out is an event in which a corporation decides to sell or spin off a portion of its business. This process can be used to realign the parent company's resources towards its core competencies and/or unlock the value of the divested asset.

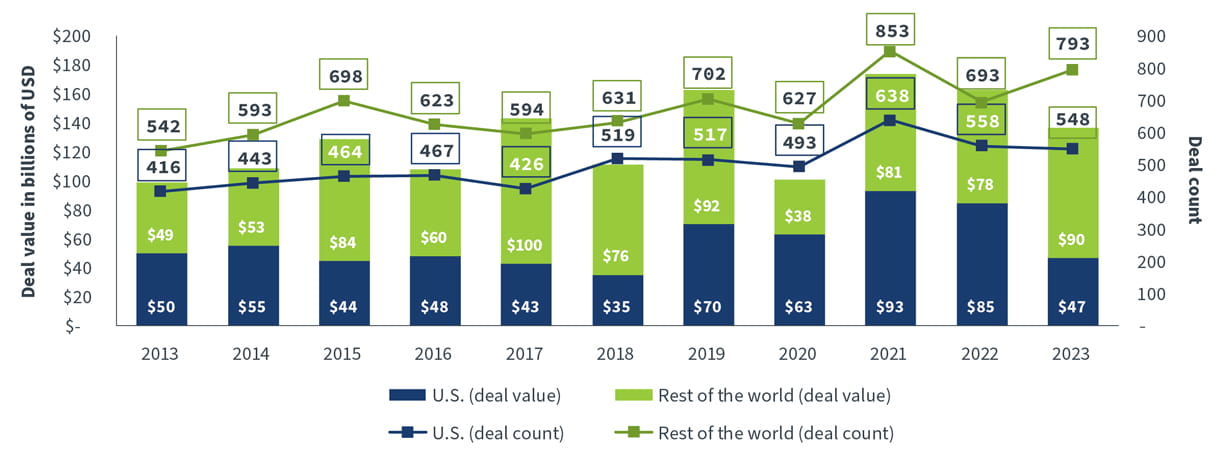

The concept of carve-outs is not new. In the 1980’s and 1990’s, carve-outs were primarily seen as a means to dispose of underperforming or non-core assets. Today, technological advancements, market volatility, and changing consumer preferences have altered the strategic importance of carve-outs. As the chart below demonstrates, we’ve seen an uptick in the number of carve out deals since 2021 both in the U.S. and globally.

Carve-outs vary significantly in complexity and scope, and can take several months to a few years to complete. This leads to a wide range in execution timelines. Key phases include:

- The initial planning and preparation phase

- The execution phase

- Post-carve-out integration phase requiring additional time beyond that to establish and reach stability and strategic alignment

Setting these milestones and tracking progress against them is key to a well-managed process.

As the use of carve-outs evolves, we are seeing a shift in business strategy that focuses on agility, specialization, and maximizing shareholder value. This article explores the challenges and benefits of a carve-out from a seller’s perspective.

Strategic benefits for sellers

A primary rationale behind a carve-out is the opportunity it presents for the seller to return to its core competencies. Maintaining focus on what a company does best is a solid strategy and a necessity for longevity and growth. Utilizing a carve-out allows companies to shed non-core, underperforming, or strategically misaligned segments of their business, helping them streamline operations and reallocate resources – both financial and human – into areas with higher potentials for growth and profitability. Strategic realignments of this nature can improve operational efficiency and effectiveness, while allowing management to concentrate on strengthening their company's core functions without the distraction that can come from managing disparate business units. It also supports a culture of excellence and innovation within the remaining core areas, potentially leading to unrealized competitive advantages and market leadership.

When a video on-demand and live streaming service agreed to sell its stake in a large book publisher to a global investment firm there were a few key considerations. In an era of chord-cutting and increased reliance on streaming services, especially in sports streaming, this video on-demand and live streaming service, like its media rivals, is contending with a challenging operating environment.

For the seller, the process allows for a reevaluation of the company’s market value, with investors and the market at large gaining a clearer view of a company’s core business performance and potential. Strategic divestment of non-core assets – similar to when an American multinational confectionary, food, beverage, and snack food company sold its gum business to an Italian multinational confectionary and gum company for $1.35 billion – can enhance shareholder value, as doing so demonstrates a commitment to disciplined capital management and strategic focus.

These benefits underscore the tactical advantages of a carve-out as a business strategy and can lead to enhanced efficiency and focus while providing strategic clarity. Through carve-outs, companies can realign with their primary strengths and capitalize on new growth avenues, in the end providing resilience and success within their business landscape.

Financial considerations and value creation

Along with the immediate cash infusion resulting from the sale of a business unit, carve-outs offer a multifaceted path towards enhanced value creation, improved financial performance, and an increase in their market valuation. This can positively affect both the parent company and the newly carved-out business entity.

A carve-out can improve the financial performance of the parent company by eliminating less focused and profitable segments, or loss-inducing segments of its portfolio. Such streamlining can lead to higher margins and better overall financial health.

A recent example has been an American healthcare company offloading a series of hospitals to strategic buyers including medical centers and healthcare systems. These divestitures not only provided billions of dollars that improved this healthcare company’s position, as indicated in their fourth quarter earnings call, but also allowed them to focus on the growth of their profitable ambulatory surgery unit.

Conclusion

It’s important to note that carve-outs executed with strategic foresight and careful planning offer many benefits including enhanced focus on core business competencies, the unlocking of hidden value, and the attainment of operational efficiencies. A carve-out will touch every aspect of a business, from human resources and IT systems to fiscal management and stakeholder relationships. Key considerations include ensuring business continuity, managing stakeholder expectations, and navigating the legal and financial complexities inherent in separating business units. The success of a carve-out is expressly tied to careful management of these elements to help ensure that both the parent company and the carved-out entity are positioned for growth and success.

The carve-out path is one of discovery, opportunity, and potential. It is a chance to reshape your business for the better.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

.png?h=600&iar=0&w=1300&hash=8FA36D04357A7AC43099A096549D8FBC)