Q1 2021: Accelerated Growth and Value Creation

Dealmakers in the Manufacturing and Distribution sector are rebounding from a year filled with uncertain market conditions. Investors and business owners alike are emerging from the pandemic with a mounting interest in accelerating growth and creating value. Despite the delays and challenges in getting deals done over the past year, the pipeline is filling and transaction activity is building.

Transaction activity in the Manufacturing and Distribution sector rode a bit of a roller coaster from quarter to quarter in 2020 (as measured by deal count), and there were (and continue to be) various challenges depending on the industry segment. But by mid-year, as people accepted and began to settle into this new reality, businesses moved forward, and so did transactions.

After the quarterly volatility of 2020, the transaction forecast for 2021 seems to indicate a very busy year for deals in the sector. Although market conditions continue to settle, many investors who focused on maintaining liquidity through the pandemic have capital to invest, and many would-be sellers who spent the last year keeping their businesses afloat may now be ready to deal.

Skip to a section:

Q1 2021 trending numbers

All data gathered from PitchBook Data, Inc., as of April 1, 2021

Capital invested by deal count

The number of deals fluctuated from quarter to quarter in 2020. Q1 2020 saw a slight falloff compared to Q1 2019, as pandemic concerns grew in February and led to mandated lockdowns in March, and business owners and investors focused on the survival of their company or their portfolios. The number of deals saw an uptick in the second quarter of 2020 as investors began to realize that COVID-19 would be a long-term concern and learned how to close deals under the new circumstances. Q3 of 2020 saw a significant decline in deals as those who did not move in Q2 settled in for the long haul. By Q4, the news of vaccine approvals helped many to see a light at the end of the tunnel, and the numbers rebounded to be almost even with Q4 2019.

Q1 2021 top investors: Most active private equity firms based on number of deals

It hasn’t taken long for some of the key players to get active in early 2021. Top private equity/buyout groups like Arcline Investment Management, H.I.G. Capital, Audax Group, KKR, L Catterton, and the Carlyle Group are setting the pace, with a total of 30 transactions between them.

Q1 2021 Top 10 deals

Two of the top deals that we’ve highlighted provide examples of an important trend that we’ll discuss in more detail below: Both Domtar Personal Care and BTG Specialty Pharmaceuticals were subsidiaries of larger organizations that were sold in part to help the parent focus on its core businesses.

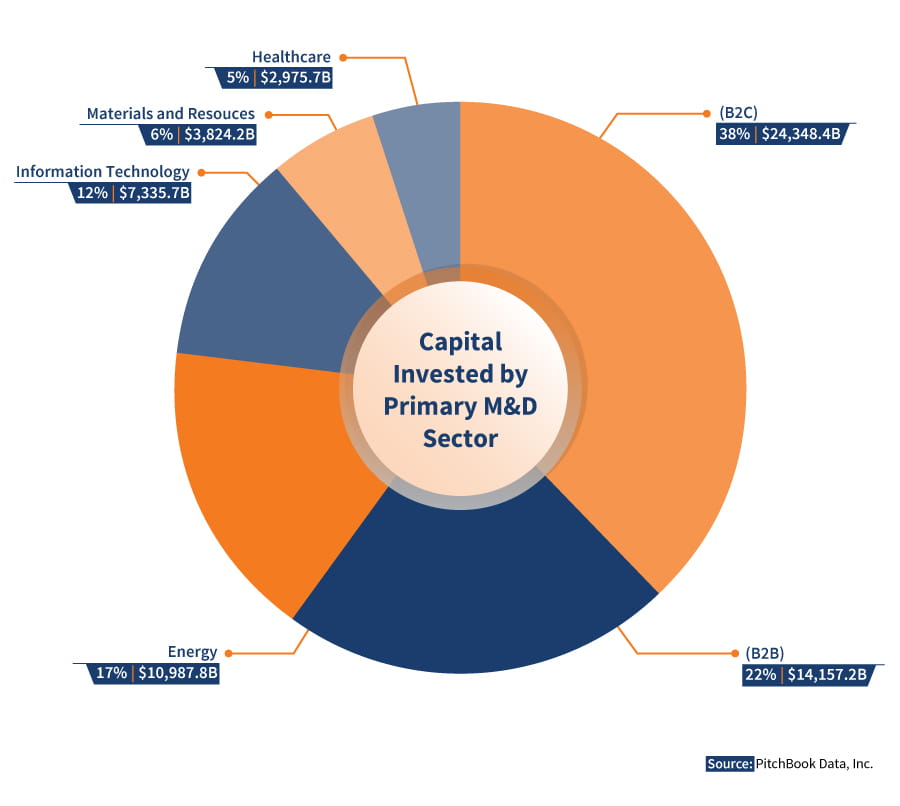

Q1 2021 capital invested by primary M&D sector

While the total capital invested is returning to pre-pandemic levels, the quarterly data shows significant shifts in what segments of the manufacturing and distribution sector are garnering the most attention. For instance:

- On the cusp of the pandemic in Q1 2020, more than 50% of the capital flowing into deals was going to the B2B segment. By Q4 2020, that was cut in more than half to only 21%, and remained almost flat in Q1 2021.

- At the same time, capital flowing into B2C has steadily increased, growing from 20% in Q1 2020 to 30% in Q4 and 38% in Q1 2021. The contrast in trends for the two “B2-” sectors likely ties to the fact that more B2C entities already had the e-commerce and “touchless delivery” capabilities that became essential during the pandemic, while B2B needed to retool operations to address new COVID-19 safety protocols and changing behaviors.

- One segment worth noting within B2C: Perhaps one of the most commonly told stories about unexpected outcomes of the pandemic has been the astronomical rise in the rate of pet adoptions, and the pet products sector has seen benefits. Online pet products retailer Chewy.com reported its busiest quarter ever last spring, with a 46% rise in net sales to $1.62 billion. One of Pitchbook’s Q1 2021 acquisitions in the food sector was for Grizzly Pet Products, a manufacturer of pet supplements and nutritional products intended for dogs, cats, and horses.

- Sectors like IT and healthcare have seen predictable jumps, although healthcare jumped all the way up to 26% in Q4 2020 only to recede back to 5% in Q1 2021. There may be hesitancy with these deals as everyone waits to see what healthcare will look like moving forward, amid the hope of increased vaccine availability and reduced hospitalizations.

Market factors impacting the deal space

As COVID-19 numbers improve in the U.S. and investors anticipate the possibility that the economy will settle into its new post-pandemic normal by the end of 2021, there are new considerations in the marketplace that buyers and sellers should take into account. Two key factors are:

Factor COVID-19 into valuations: A key concern for investors is the impact that COVID-19 had on the business historically and long-term impact going forward. Investors can quite easily isolate any government funding or credits taken by a company, but identifying how a company’s revenue pipeline and operations have changed purely due to COVID-19 may be more difficult. During due diligence, investors and their advisors should inquire and analyze data to understand the company’s adaptation during COVID-19, including customer gains and losses, as well as changes in distribution channels, employee management, technology, and travel. Did the management team learn to operate smarter and strengthen margins to have a long-term benefit to the business?

Look for targets that are tightening their focus on a core mission: The pandemic caused a lot of businesses to take a step back and focus on their core strategy and operations. There has been a rise in carve-outs as businesses spin-off divisions that no longer fit with management’s strategic goals. As noted in the discussion of top manufacturing deals in Q1 2021, two significant deals of the quarter involved subsidiaries that didn’t align closely enough with the parent’s corporate mission.

We’re also seeing this trend extend to private equity groups. Several well-known investors that had bought up businesses in a wide variety of Manufacturing and Distribution sectors have begun to pare down their holdings to concentrate on two or three sub-sectors that they can manage with a deeper expertise.

What’s next?

Three key signs point to a significant year for transactions in the Manufacturing and Distribution sector.

1. Sellers who planned to be in market in 2020 but shifted focus to operations when the pandemic hit are now ready to return to their potential transactions.

2. There are also many owners who were previously undecided about selling and are now ready to move forward, driven by operational fatigue. These potential deals may not be as far along as those that were planned before the pandemic and put on hold, but depending on the seller’s motivation and the business’s readiness for due diligence testing, they could still get to market relatively soon.

3. The change in presidential administrations has raised concerns about possible tax increases, especially on capital gains. Many owners would rather get a deal done early than wait and potentially lose a significant percentage of their gain to taxes.

Whether you are considering selling or investing in a business, a discussion with a CohnReznick advisor is an excellent first step toward getting the most out of your transaction.

Food manufacturing deals

If there’s one M&D sector that continues to drive M&A activity, it’s food and beverage. With many Americans spending a lot of time at home, households have been cooking their own food at extraordinary levels, driving significant demand for certain food and beverage products. Two of the most talked-about trends in the food and beverage sector are:

- Frozen foods: There was a 23% increase in the sale of frozen foods for the 52-week period ended Feb. 6, 2021, according to NielsenIQ data. The sales boost can be attributed to people working from home and eager for quick, easy meals, as well as the advent of improved cooking technologies for frozen foods, such as the air fryer.

- Health-focused and plant-based foods: A trend for many years now, consumers continue to move toward healthier, clean eating and less meat. In a time when demonstrations and product sampling are at an all-time low, consumers are still purchasing new products focused on using whole foods without processing or additives. There has been significant growth in plant-based protein, amid this health trend and as burger substitutes have grown closer in taste to real meat; one grocery distributor said in late 2020 that sales of frozen plant-based meat were up 560% at its stores. We have even seen an increased demand in food products specifically providing Vitamin D as consumers are outdoors less.

When it comes to market factors affecting the deal space, the food manufacturing sector clearly reflects some of the trends that we’re seeing across the economy as a whole. Leaders in this sector are focusing their M&A activities on strengthening core product lines and cutting losses in segments that don’t align well with their current mission. Hershey’s activities in 2020 provide two excellent examples of the kinds of transactions we can expect going forward:

- In late 2020, Hershey invested an undisclosed amount in healthy snackmaker Quinn Snacks. The transaction continues a pattern established by the iconic chocolatier in recent years of focusing its M&A activity in two key snack food segments where it had not been meeting consumer demand: “better-for-you” healthy tidbits and salty, savory snacks. Since 2017, Hershey has acquired such well-known brands as SkinnyPop and Pirate’s Booty.

- Earlier in the year, Hershey sold off its Krave jerky brand to a private equity investor run by the person who had originally founded the brand. The carveout shows that M&A is a two-way street when it comes to focusing in on core functionalities. Hershey’s CEO said in a Q1 2020 investor call that selling Krave and two other brands would enable them to prioritize assets in salty snacks and nutrition bars, and noted, “These are great brands that continue to resonate with consumers, but they require a different go-to-market model that we believe is better supported by other owners.”

Another market-wide trend hitting the food and beverage sector is the increase in activity involving special purpose acquisition companies, or SPACs – companies that exist solely to acquire private companies and take them public, as an alternative to a traditional initial public offering (IPO). Among Pitchbook’s Top 20 deals closed in Q1 2021 was the acquisition of Wholesome Sweeteners by Whole Earth Brands, which was formerly a SPAC known as Act II Global Acquisition Co. that last year purchased two other businesses in the sector and went public. The entry of deep-pocketed SPACs in this sector is likely to make the competition for attractive targets more intense.

Contact our team to learn more about opportunities in the food manufacturing sector.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.