In 2016, the Financial Accounting Standards Board (FASB) issued the new lease accounting standard-ASC 842, Leases that modifies and replaces current financial accounting and reporting of lessees and lessors. Public companies were required to adopt the new standard for fiscal years beginning after December 15, 2018, while private companies had additional time to comply, which was further extended in the wake of the COVID-19 pandemic. Currently, private companies are required to comply with the new lease accounting standard for fiscal years beginning after Dec. 15, 2021.

The additional time granted to private companies for adopting the new lease accounting rules, on top of all the issues corporate finance leaders have had to deal with during the last 18 months of the pandemic, has led to a certain level of complacency amongst many C-suite leaders and financial executives at private companies. In many cases, the new standard is viewed as yet another accounting change among a plethora of other priorities. From our experience, we believe that many private companies will find it more difficult and time-consuming to transition to the new leasing standard than they anticipate. This article, the first in our thought leadership series, Lease Accounting: Your Guide through Change, is focused on assisting private companies when navigating transition and to address potential challenges posed by implementing the new standard.

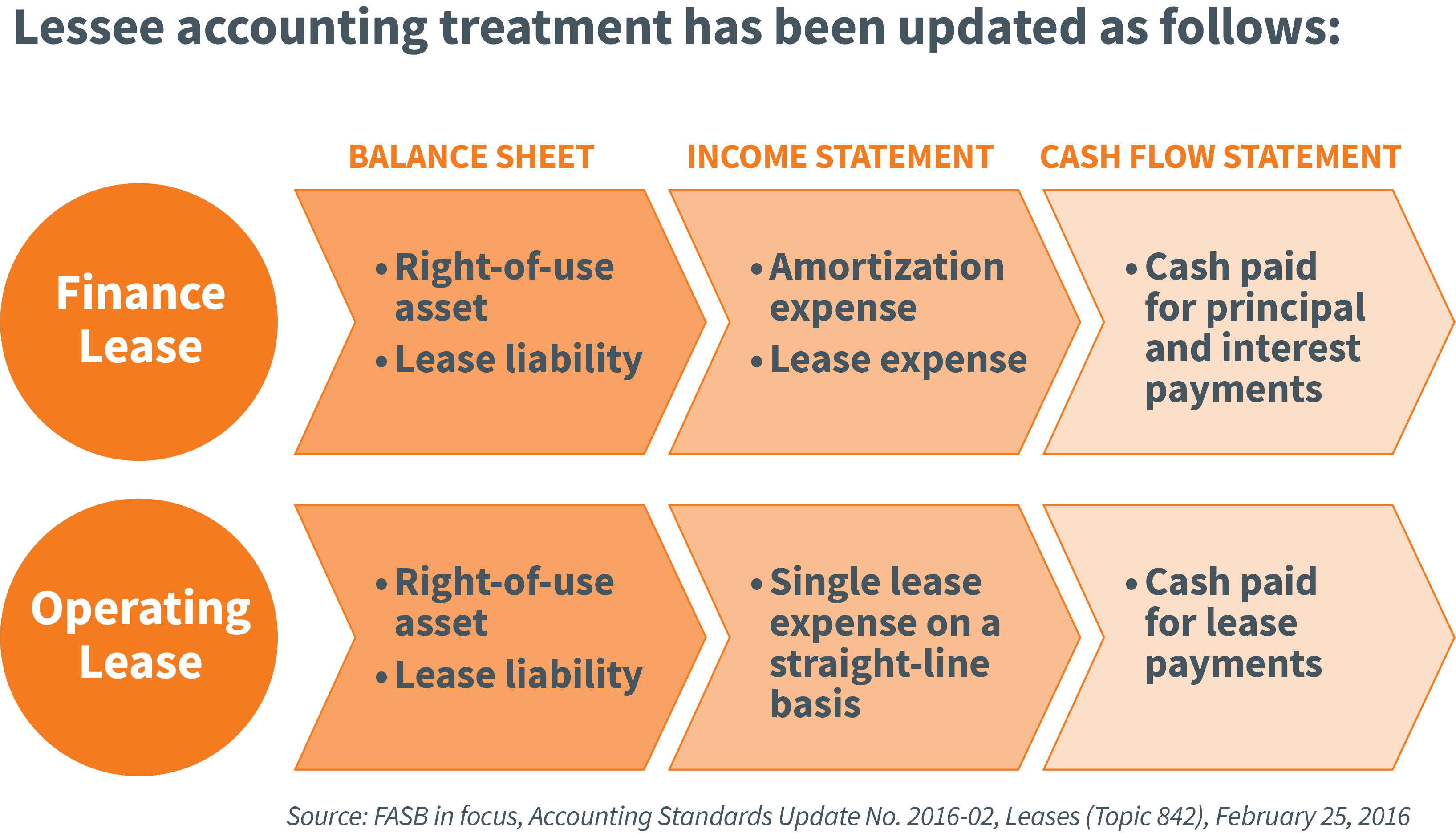

Topic 842 brings most operating leases on to lessee balance sheets. Previously, only capital leases (referred to as “finance leases” under the new standard) were required to be recognized on lessee balance sheets as capital lease assets with a corresponding debt-like liability. The new standard also modifies the definition of a lease and provides that part of a contract can meet that definition. Lease identification is a prominent exercise under the new standard, especially for lessees whose operating leases will be reflected on-balance sheet as right of use assets (component of property, plant and equipment) with corresponding lease liabilities reflecting the discounted amount of lease payments payable over the lease term. The criteria used to classify leases by lessees and lessors have been changed to be more principles based, and a new lease classification criterion has been added for specialized assets. The table below provides an overview of lessee accounting under Topic 842.

Challenge: Bigger balance sheets

When we last reviewed this information, we reported that more than three-quarters of the top 100 U.S. companies expected to see a material impact on their balance sheets. As the public company deadline has now passed, we are now able to see that the expectation was accurate.

These reports alone, which are emanating from companies that possess state-of-the-art reporting and compliance capabilities, should serve as a wake-up call for any private company CFO, CAO, or Controller planning to apply a wait-and-see approach to tackling the new standard.

“Outside of larger public companies, my sense is reporting entities are generally not as prepared for this as they probably should be at this point. There are considerations involved with transition. Adjustments will be necessary to accounting processes and policies, and there may be unique considerations for private entities, especially those that are closely held,” says Matthew Derba, Director, National Assurance at CohnReznick.

“Many private companies are unprepared for the wide-ranging effort required to meet the leasing standard, especially after they just tackled revenue recognition,” added Marisa Garcia, a Partner within CohnReznick Advisory.

Challenge: What are we leasing?

When we last reviewed this information, we reported that more than three-quarters of the top 100 U.S. companies expected to see a material impact on their balance sheets. As the public company deadline has now passed, we are now able to see that the expectation was accurate.

Challenge: Where are our leases maintained?

Many organizations, especially companies that have decentralized and/or global operations, have expressed concern over their ability to identify and track down all their leases, with some dating back many years. Organizations will need to track down and, in some cases, may seek to use this opportunity to renegotiate or restructure certain leasing arrangements. Depending on the organization, these efforts may entail a significant amount of up-front time and effort, both internally and with external vendors. Many companies use Excel spreadsheets, which may not be centrally maintained, for their accounting and financial reporting of their leases. For many, if not most, organizations, the potential magnitude of the accounting impact of the new standard will necessitate them to implement a controlled process for lease management, administration and accounting that is integrated into the organization’s overall financial reporting processes and internal control structure.Challenge: Embedded leases

Given that part of a contract can meet the definition of lease, not all leases will be apparent. Leases could be buried within seemingly non-lease transactions such as product or service arrangements involving the use of property, plant or equipment, and are therefore more difficult to identify. Identifying embedded leases such as these will require companies to have tailored processes, and will have a more prominent role under Topic 842. Accounting for an arrangement containing an embedded lease component will depend on the overall arrangement, the organization’s accounting policy elections and will require management judgment and, potentially, estimation.Challenge: Determining discount rates

The new lease accounting standard requires lessees and lessors to discount future lease payments using the rate implicit in the lease. A lessee, however, may use its incremental borrowing rate if the rate implicit in the lease cannot be readily determined. A lessee’s incremental borrowing rate will generally vary between leases having different terms and payment amounts, and is the rate a lessee would pay on funds borrowed on a collateralized basis. However, leases having similar characteristics may qualify for a portfolio approach, enabling a single discount rate to be applied to a portfolio of similar leases. The lessee’s incremental borrowing rate must be specific to:

- The lessee: an incremental borrowing rate is company-specific, and considers the lessee’s credit risk. This can pose challenges for large organizations with decentralized operations, as well as smaller organizations that have not had recent financing transactions.

- The term of the lease: a discount rate applied to a 5-year lease will probably not be the same as a discount rate applied to a 20-year lease.

- The amount of the funds ‘borrowed’: a higher amount of lease payments is presumed to result in a higher discount rate as compared to a discount rate determined for a lease with a lower amount of lease payments.

- The ‘security’ granted to the lessor: the standard requires a lessee’s incremental borrowing rate to reflect that of a secured borrowing. Accordingly, the nature and quality of the collateral must be considered.

- The economic environment: the market conditions in the geographic location the lease is originated and the currency in which the lease is denominated must be considered. This adds complexity for companies with global operations that conduct their treasury operations locally or regionally.

Challenge: Choosing the right tech platform

Many companies are being contacted by lease administration and accounting technology companies offering to sell software that will facilitate and automate the transition to the new lease accounting standard. If only it were that simple. Internal resources are often stretched on other critical IT projects, including current and future upgrades to enterprise resource planning (ERP) software, and the finance and accounting departments often do not have the resources with the necessary skills to deploy a new system. An accounting software will facilitate and automate the process, but it will not provide the technical assessments previously discussed. Further, the data collection effort to identify the population of leases and their key terms remains, regardless of whether a system is deployed. CohnReznick’s partnership with artificial intelligence technology leader, Leverton, automates the lease abstraction process and provides efficiency in the data collection process.

When properly planned for and implemented correctly, a technology platform for lease accounting may be the right component of an implementation plan for companies of a particular size seeking to automate and centralize their processes. While there are many platforms available, it is also difficult to know which one will be best for your organization. Without the right system in place, manual processes may become onerous as the sheer volume of data continues to grow.

This issue is especially critical for a manufacturer working through its factory’s connectivity and automation as part of industry 4.0. Companies that are planning to automate all their other processes must bring in an accounting platform that will speak to every other system to potentially offer cost-saving opportunities. Anything less would be counterproductive. However, the implementation of a new system, that will work with those currently in place, can also add to the implementation timeline.

Challenge: Project team

Transitioning to the new lease accounting standard is going to require a significant effort by your accounting team, who are likely already stretched with special projects in addition to the requirements of their daily roles. Further, the effects of the new standard may very well extend beyond an accounting departments to impact tax, treasury and potentially operations. How to source this project for an initial implementation, and how you assign responsibilities to sustain the ongoing accounting prospectively are decisions that should be made in the pre-implementation phase. As you reorganize and prepare for this undertaking, you’ll want to be certain you have the right experience and training on hand to ease the transition.Plan ahead

The new lease accounting standard is poised to impose significant and possibly unforeseen transition challenges. That’s why it’s important to start planning for the transition now. We believe it can take six months to complete all the necessary steps to become fully compliant. This timeline does not necessarily factor in possible delays and complications. We believe that each organization comes with its own set of challenges and will therefore need to adjust their implementation timelines accordingly.

Of course, some companies will be tempted to put off their compliance efforts, as Topic 842 does not carry direct fines or penalties for noncompliance. However, we believe procrastination carries significant organizational and strategic risks. In our follow-up article, we will focus on the unforeseen risks your company might run into waiting too long to plan for transitioning to Topic 842, and steps that can be taken to reduce such risks.

Marisa Garcia

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Lease Accounting Resource Center

On-Demand Webinar: The Leasing Standard Maintaining Momentum Through The Final Stages