Impact of credit losses on Topic 320 available-for-sale debt securities

Entities will not apply the CECL model described in ASC 326-20 to their investments in debt securities classified as available-for-sale under Topic 320 Debt Securities. Under Topic 320, investments in debt securities classified as available for sale (AFS debt securities) are carried at fair value with unrealized gains and losses recognized in other comprehensive income. Instead of the CECL model, entities will apply the guidance in ASC 326-30 to determine whether their AFS debt securities, including loans that meet the definition of a debt security and that are classified as available for sale, are impaired.

Identifying and evaluating an impairment of an AFS debt security

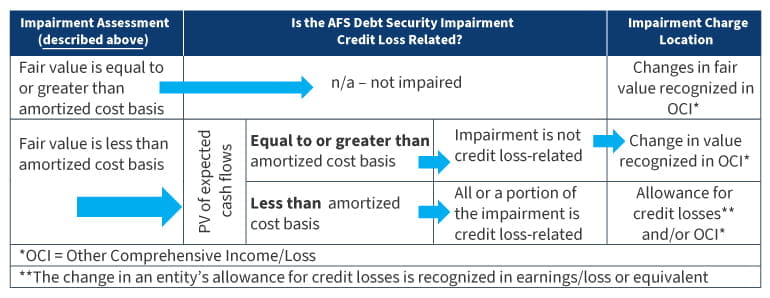

An investment in an AFS debt security is impaired if its fair value is less than its amortized cost. An entity performs an impairment evaluation for each individual AFS debt security (i.e., on an individual debt security basis). This is in contrast to the CECL model (ASC 326-20), which is generally applied collectively by pool or group of similar financial assets.

Determining whether an AFS debt security impairment is credit-related

When an AFS debt security is impaired, an entity will assess whether the decline in the debt security’s fair value is below its amortized cost basis results from a credit loss or other factors. An entity performs this assessment by comparing the present value of cash flows expected to be collected from the AFS debt security with its amortized cost basis.

The following table depicts how an entity should evaluate the results of such an assessment.

Entities should consider the guidance in ASC 326-30-55-1 through 55-2 when assessing whether a credit loss exists. Entities with substantial doubt about their ability to continue as a going concern should consider the potential impact of management’s plans to mitigate such concern and, to the extent they involve the sale of AFS debt securities, whether there is an indication of impairment.

Measuring and recognizing a credit loss on an AFS debt security

An impairment charge on an AFS debt security related to a credit loss is recognized in earnings/loss (or equivalent thereof) as a current period change in the entity’s allowance for credit losses. A credit loss exists when an AFS debt security is impaired and the present value of the security’s expected cash flows is less than its amortized cost basis. The amount recognized as a current period charge for a credit loss on an AFS debt security is limited to the amount by which its amortized cost basis exceeds the fair value of the security. The amount by which the impairment exceeds the current period credit loss would be recognized in other comprehensive income/loss (OCI) to the extent that it is more-likely-than-not that the amortized cost of the AFS debt security will be recovered.

Conversely, if there is an impairment of an AFS debt security and it is more-likely-than-not that the amortized cost of the AFS debt security will be recovered, but the present value of the security’s expected cash flows is equal to or exceeds its amortized cost basis, then there would be no current period credit loss and the change in value of the AFS debt security would be recognized in OCI.

Present value of the expected future cash flows of an AFS debt security

Estimates of expected future cash flows should be an entity’s best estimate based on past events, current conditions, and reasonable and supportable forecasts. Available evidence is considered in developing the estimate of expected future cash flows. The weight given to the information used in the assessment should be commensurate with the extent to which the evidence can be verified objectively. If an entity estimates a range for either the amount or timing of possible cash flows, the likelihood of the possible outcomes should be considered in determining the best estimate of expected future cash flows. Available information includes existing environmental factors, for example, existing industry, geographical, economic, and political factors that are relevant to the collectability of that debt security. Those expected future cash flows should be discounted at the effective interest rate implicit at the date the security was acquired.

Effective dates of, and transitioning to, Topic 326

Topic 326 is effective as follows:

- For public business entities that meet the definition of a Securities and Exchange Commission (SEC) filer, excluding entities eligible to be smaller reporting companies as defined by the SEC, for fiscal years beginning after Dec. 15, 2019, including interim periods within those fiscal years. The one-time determination of whether an entity is eligible to be a smaller reporting company shall be based on an entity's most recent determination as of Nov. 15, 2019, in accordance with SEC regulations.

- For all other entities, for fiscal years beginning after Dec. 15, 2022, including interim periods within those fiscal years. This is generally expected to include certain:

- Emerging Growth Companies (EGCs)

- Smaller Reporting Companies (SRCs)

Topic 326 will be adopted by means of a cumulative effect adjustment to the opening retained earnings as of the beginning of the first reporting period for which the standard is effective.

Monica Peborde

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture – addressing any industry-specific needs.