IPO solutions for today’s challenges

Whether you take a traditional approach or a SPAC approach to your IPO, the goal remains the same: Simplifying the IPO process to allow you to focus on your business and people.

Where are you on your IPO roadmap?

-

Navigating the traditional IPO route is an intricate yet rewarding journey for any company. A traditional IPO allows the company to use their stock as currency, providing businesses the opportunity to raise substantial amounts of capital. The high amount of capital raised can increase a company’s visibility and credibility and attract new customers quickly.

Becoming a public entity involves proper preparation, articulation of your value proposition, and visualization of your growth plan to ensure you are showcasing a strong business to your investors. Our traditional IPO services can help guide you on the best financial structuring, legal requirements, and market positioning to help ensure a successful public debut.

-

Embarking on a reverse merger with a special purpose acquisition company (SPAC) offers an alternative to the traditional IPO process. In comparison with a tradition IPO, a de-SPAC is oftentimes faster, more cost-efficient, and can lean on the operational expertise of the SPAC sponsors .

Our de-SPAC services are tailored to help you effectively plan; navigate the regulatory requirements (SEC reporting and disclosure rules, US GAAP, and IFRS for cross-border transactions); and work side by side with stakeholders to enable a successful transition to a public company. We assist you in preparing for a transaction through due diligence, complex tax planning, fair valuation, audit readiness, and providing post-public optimization, technology, cyber security governance and internal control support.

-

Navigating the compliance requirements for either a traditional or SPAC IPO can be complex. We can help with SOX readiness and ongoing compliance by strengthening your internal controls framework through comprehensive assessment and mitigation of emerging risks, offering internal audit outsourcing and co-sourcing support. Additionally, we proactively protect and address cybersecurity and information technology risks, and provide identification and guidance on ESG and sustainability reporting as well as regulatory requirements.

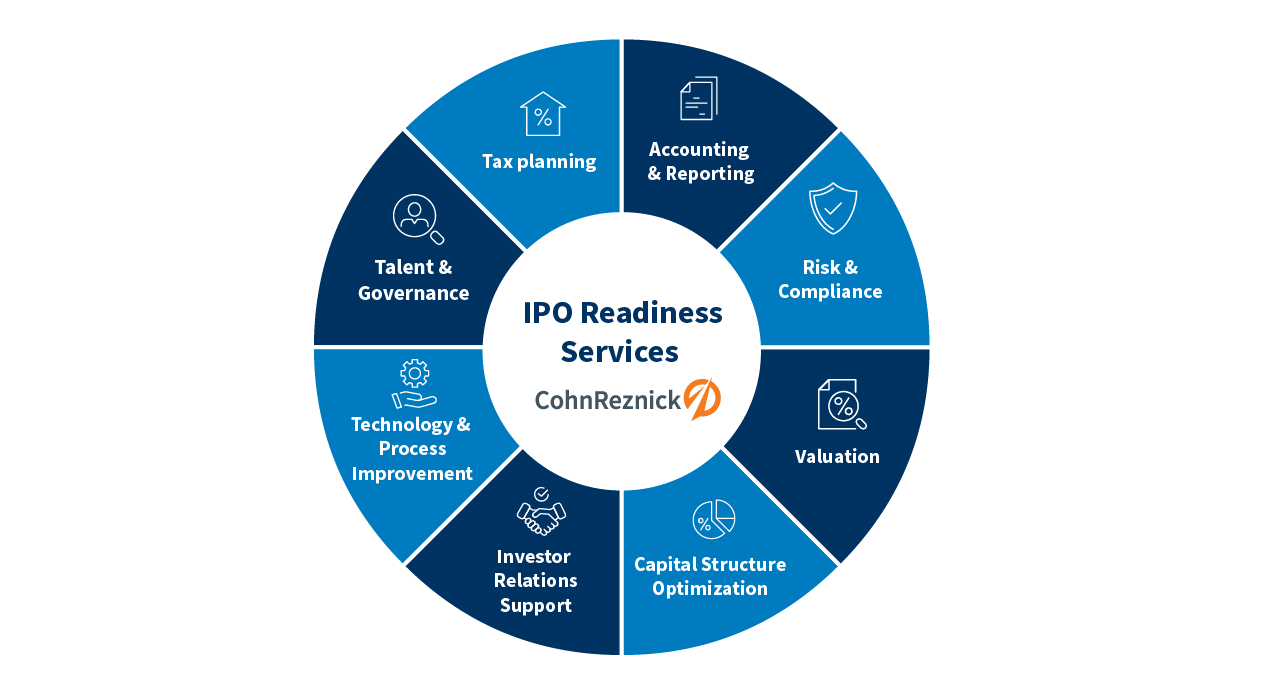

How we can help

Seasoned team

Scalable solutions

Regardless of the complexity, we offer scalable and holistic solutions that are aligned to your company’s size, unique to your needs, and help support your business objectives with a scalable, agile, and transparent approach.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Our CFO Advisory solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture – addressing any industry-specific needs.

.jpg?h=400&w=1380&hash=A885503AF4D3222A1CFA92E8EC5363AD)