Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Q&A: IRA and direct/elective pay FAQs for exempt organizations

Exempt organizations can now benefit from tax credits for clean energy technologies – but the rules are complex to navigate.

The Inflation Reduction Act of 2022 (IRA) introduced and expanded tax credits for clean energy technologies and established a new direct pay provision. Direct pay allows exempt organizations and governmental entities to benefit from these credits by providing cash payments for the value of the credits. On March 5, the IRS released Final Rules for elective pay, now interchangeably called “direct pay.”

Below, we’ve compiled a list of common questions and answers to help entities interested in these opportunities navigate these rules, determine applicability, and understand next steps to potentially take advantage of these credits.

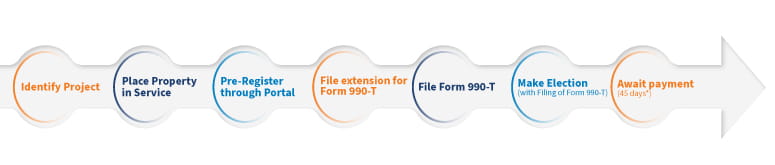

Question: What is the process?

Answer:

Question: What are the important dates an organization needs to be aware of?

Answer:

- The date a property was placed in service; a property must be placed in service before you can register and receive the credit.

- The deadline for the Form 990-T is the 15th day of the fifth month after the tax year ends (i.e., 5/15/24 for a 12/31/23 tax year).

- An extension may be filed to extend the due date by six months (i.e., to 11/15/24 for a 12/31/23 tax year).

Question: What credits are eligible for “Elective Pay”?

Answer: Including Internal Revenue Code Section reference and IRS form numbers:

- Energy Credit (48), (Form 3468, Part VI)

- Clean Electricity Investment Credit (48E), (Form 3468, Part V)

- Renewable Electricity Production Credit (45), (Form 8835, Part II)

- Clean Electricity Production Credit (45Y)

- Commercial Clean Vehicle Credit (45W), (Form 8936, Part V)

- Credit for Alternative Fuel Vehicle Refueling / Recharging Property (30C), (Part 8911, Part II)

- Zero-emission Nuclear Power Production Credit (45U), (Form 7213, Part II)

- Clean Hydrogen Production Credit (45V), (Form 7210)

- Clean Fuel Production Credit (45Z)

- Carbon Oxide Sequestration Credit (45Q), (Form 8933)

- Advanced Manufacturing Production Credit (45X), (Form 7207)

- Qualifying Advanced Energy Project Credit (48C), (Form 3468, Part III)

Question: What are the most common project types for which our clients are seeking/obtaining credits?

Answer:

- Solar panels

- Electric vehicle charging stations

- Battery storage

- Heat pumps

Question: What are some examples of what we’ve seen with our clients?

Answer:

- Exempt entities that own or are a partner in Section 42 affordable housing projects looking to see how direct pay might work for them

- Schools and universities installing solar, storage, or micro-grids seeking to claim direct pay to improve the economics of such investments in their infrastructure

- Energy services companies seeking help in advising their exempt and governmental clients on the value of direct pay and assisting them to claim direct pay

- Nonprofits serving LMI communities looking to direct pay to provide energy to low-income schools and community facilities serving families in the community

- Hospitals looking to use solar and storage to manage their energy and energy reliability needs

Question: If an entity placed an eligible item into service between Jan. 1, 2023, and June 30, 2023, are they eligible for the credit?

Answer: Maybe. The final regulations confirmed that the tax credit is available for the 2023 tax year. Depending on the fiscal year-end of the client and history of tax return filings, they may be eligible, and they may not. The Final Rules made clear, taxpayers that regularly file a Form 990, a Form 990-T, or both with a fiscal year ended between Jan. 31 and June 30 cannot utilize the credit for an item placed in services between these dates. However, a taxpayer that has not filed either form previously can elect to use the December 31 year-end to take advantage of the credits.

Question: When can an exempt organization expect to receive their cash payment?

Answer: The IRS issued a news release on March 19 that noted that “under the statute, a taxpayer is not entitled to the elective payment until the due date of the return, even if the taxpayer files the return before that date.” As such, they noted, in general, entities can expect payment issuance within 45 days of the due date of their annual return.

Question: We do not own the property, but use it daily. Can we still take advantage of the credit?

Answer: No, an organization must own property to take advantage of the credit. This can be established through:

- Direct ownership,

- Ownership through a disregarded entity, or

- Owning “an undivided interest in an ownership arrangement treated as a tenancy-in-common or pursuant to a joint operating arrangement that has properly elected out of subchapter K under Section 761,” an IRS FAQ states.

Question: We own more than one property that is eligible for the credits. Can we consolidate them into one registration?

Answer: No. In order to take advantage of these incentives, an exempt organization must use the portal and pre-register each property; where there are multiple assets within one registration, each eligible asset is added separately within that registration.

Question: Is guidance for co-owned property final?

Answer: Also on March 5, the Treasury issued a separate Notice of Proposed Rulemaking (NPRM) to provide further clarity to applicable entities that co-own clean energy projects. The comment period is open for 60 days following the publication of the NPRM (i.e., until May 10, 2024). The proposed rulemaking was intended to “provide clarity and flexibility for applicable entities that co-own clean energy projects.” Pursuant to the release, the intention is to:

- “Permit renewable energy investments to be made through a noncorporate entity, rather than requiring direct co-ownership of the property or facility by the applicable entity;

- “Modify certain joint marketing restrictions to provide that multi-year power purchase agreements would not violate the requirements to elect out of partnership tax treatment.”

Question: Is there an impact if the property is also funded by a grant or forgivable loan?

Answer: Yes. The total amount of the credit plus any grants cannot exceed the cost of the investment itself.

Question: Are there any IRS publications available to help?

Answer: Yes. The IRS provided the following specific to tax-exempt organizations: Publication 5817-D (Rev. 3-2024).

What does CohnReznick think?

We’ve listed just a few of the questions we have been seeing. The large number of questions surrounding this legislation is not surprising, given its scope and complexity. With these credits available through the year 2032, there are many potential opportunities to take advantage of.

We encourage you to:

- Familiarize yourself with these rules.

- Consider these rules for all new developments and properties.

- Consider if these rules can impact recent projects.

- Be on the lookout for future guidance from the IRS and our team.

- Reach out to your tax advisor with any questions.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.