Business combinations – Identifying a business combination or asset acquisition using the screen test

Read about Topic 805’s “screen test” for whether an acquired set of assets is a business, which can significantly impact how to account for the transaction.

We began our three-part series on business combinations with an overview for private companies of the acquisition method. In this article, we will provide more in-depth discussion on identifying an acquisition as a business combination or an asset acquisition.

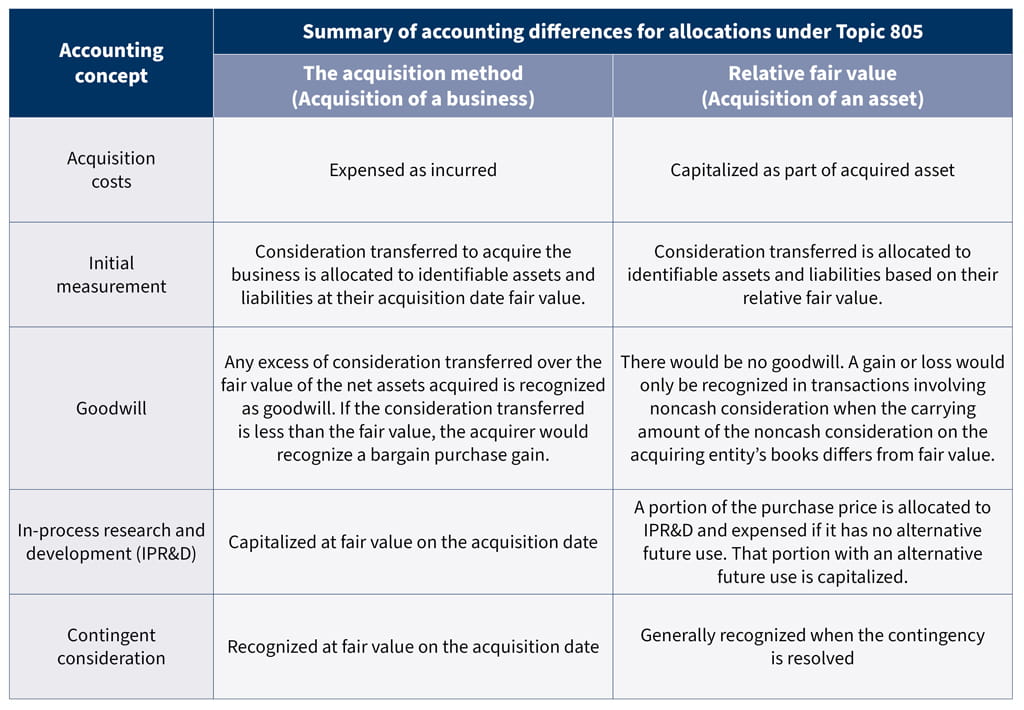

Business Combinations (Topic 805) – Clarifying the Definition of a Business (as updated by Accounting Standards Update 2017-01) provides guidance to assist entities with evaluating when an integrated set of transferred assets and activities (referred to as a “set”) meets the definition of a business. Transactions where the set does not meet the definition of a business are accounted for as asset acquisitions. Determining whether a set constitutes a business under Topic 805 is critical because the accounting for a business combination differs significantly from that for an asset acquisition. The below is a listing of those accounting differences:

FASB notes in ASU 2017-01 that the new definition of a business was developed in response to stakeholders providing feedback that the definition of a business in Topic 805 was “applied too broadly, resulting in many transactions being recorded as business acquisitions that to them are more akin to asset acquisitions.”

Definition of a business

Under Topic 805 as updated by ASU 2017-01, a business is an integrated set of activities and assets that must consist of, at a minimum, a) an input and b) a substantive process that when applied to the input significantly contributes to the ability of the set to create outputs.

This definition contrasts with the previous definition, as there were no specified minimum inputs or processes in order for a set to meet the definition of a business if a market participant was capable of continuing to produce outputs (i.e., by integrating the acquired business into its own inputs and processes). The ASU also narrowed ASC 805’s definition of outputs from “…a return in the form of dividends, lower costs, or other economic benefits…” to “…goods or services to customers, investment income (such as dividends or interest), or other revenues.”

Application of the screen (“Single or Similar Asset Threshold”)

Before determining whether the acquisition of a set meets the definition of a business, reporting entities are first required to apply a screen. If the transaction meets the criteria in the screen, the set will be accounted for as an asset acquisition. The screen simply states that a set would not be considered to be a business when there is a concentration of substantially all of the fair value of the gross assets in either of the following:

1. An individual asset or a group of assets that could be recognized and measured as a single identifiable asset, described in ASC 805-10 as:

a. “A tangible asset that is attached to and cannot be physically removed and used separately from another tangible asset (or an intangible asset representing the right to use a tangible asset) without incurring significant cost or significant diminution in utility or fair value to either asset (for example, land and building)

b. “In-place lease intangibles, including favorable and unfavorable intangible assets or liabilities, and the related leased assets.”

2. A group of similar identifiable assets. Topic 805 provides asset groups that specifically should not be considered similar (such as tangible and intangible assets).

If a transaction does not meet the screen, the reporting entity would need to determine whether the set has, at a minimum, an input and a substantive process that when applied to the input significantly contributes to the ability of the set to create outputs.

The following are summaries of two examples from Topic 805 to illustrate the screen test; see Topic 805 for more.

The acquisition of real estate

Background facts

ABC’s operations consist of acquiring, renovating, leasing, selling, and managing real estate properties. ABC acquires a portfolio of 10 single-family homes. Each home has 1) an in-place lease and consists of 2) land, 3) building, and 4) improvements.

Scenario 1 – Screen met

ABC did not acquire any employees or other assets in the transaction. The objective of applying the screen is to determine whether the fair value of the gross assets acquired is concentrated in a single identified asset or group of similar assets. For purposes of applying the screen, ABC must identify the assets acquired. Therefore, ABC determines that the homes represent 10 single identified assets because:

a. Each home consists of land with a building and improvements attached thereto. The building and improvements cannot be removed from the land without incurring significant cost and should therefore be considered a single asset; and

b. The in-place lease for each home is an intangible asset that, for purposes of applying the screen under ASC 805, should be combined with the related real estate considered a single asset.

Scenario 2 – Screen not met

In addition to the 10 single-family homes, ABC also acquires six 10-story office buildings that are fully occupied and have significant fair value. The six office buildings have contracts with vendors for cleaning services, maintenance, and security. ABC does not acquire any employees involved in strategic management, tenant management, or leasing, and will use its internal resource to fulfill those roles. ABC does, however, acquire certain building employees, but intends to replace them and property management with its own internal resources.

a. ABC concludes the office buildings and single-family homes are not similar assets because the nature and risk characteristics of operating them are significantly different. The risks associated with the scale of operating an office building, as well as obtaining and managing those tenants, are significantly different from those associated with single-family homes.

b. ABC therefore concludes that substantially all of the fair value of the gross assets acquired is not concentrated in a single identifiable asset or group of similar identifiable assets, and the transaction has not met the screen. Accordingly, ABC must evaluate whether the set has, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs under the framework in Topic 805. In determining how to apply the framework, ABC must first determine whether the set has outputs. Through in-place leases for the office buildings and single-family homes, the set has continuing revenues, and therefore it has outputs.

c. ABC must then assess whether it has acquired the following:

- Employees that form an organized workforce that possesses the necessary skills, knowledge, or experience to perform an acquired process (or group thereof) that is/are critical to the ability of the integrated set to continue producing outputs – Criteria not met

- An acquired contract providing access to an organized workforce that performs a substantive process – Criteria not met

- Acquired process that when applied to acquired inputs, significantly contributes to the set’s ability to continuing producing outputs and (a) cannot be replaced without significant cost, effort, or delay in the set’s ability to continue producing outputs and (b) is considered unique or scarce – Criteria not met

As none of the criteria were met, “ABC concludes that the set does not include both an input and substantive processes that together significantly contribute to the ability to create outputs and, therefore, is not considered a business,” Topic 805 states.

Conclusion

As noted above, if the transaction meets the criteria in the screen, the set will be accounted for as an asset acquisition. However, if the criteria in the screen is not met, that does not automatically mean the transaction will be accounted for as a business combination. Careful consideration of the facts and circumstances of the transaction will need to be considered to determine if it meets the definition of a business under Topic 805.Up next

Click to continue to our final article in this series, in which we discuss certain private company alternatives to goodwill and business combinations.

And if you're finding this series helpful, be sure to subscribe now to have future articles, event invitations, and other relevant content sent straight to your inbox. (Be sure to select "Attest and Technical Accounting Updates" under "Topics I'm interested in.")

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.