Real estate gift and estate tax valuations of fractional interests considerations

When a property is gifted, an exercise of appraising the fair market value of the fractional interest needs to be done. Make sure not to oversimplify valuations.

Real estate is one of the most frequently gifted asset categories in the United States. The exercise of gifting fractional interests in real estate (albeit through a tenancy-in-common interest or partnership interest) typically involves an appraisal of the fair market value of the gifted property. It is important to remain cautious of valuations that oversimplify this exercise as there are several complexities that can be overlooked and lead to a misstatement of value – leaving money on the table or exposing you to unwanted adjustments and harsh penalties.

Distribution structures of real estate holding partnerships

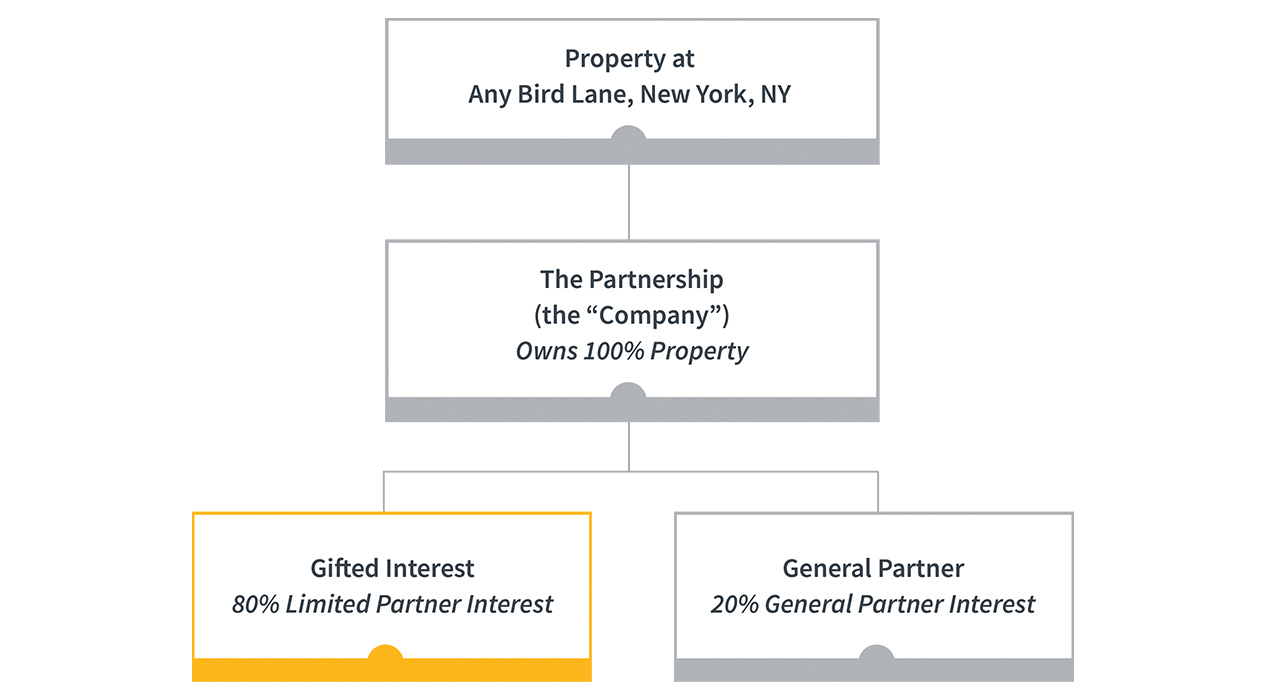

One of the most overlooked complexities is the distribution structures of the real estate holding partnership. As an example, we will assume the following operating structure:

In this example, the gifted interest is an 80% limited partner interest in a real estate holding partnership. A common misconception is that the value of this interest, before recognition of any discounts, is simply the 80% multiplied by the fair market value of all assets held by the company less liabilities. This may be the case; however, often general partners in real estate holding partnerships are entitled to a disproportionate amount of the cash flow distributions from the entity. This is commonly the case for affordable housing projects or market rate deals involving a sponsor and limited partner equity, and is compensation for organizing and managing the deal. It can take form in incentive fees eating a significant portion of cash flow, general partner promotes, and other nuances typically discussed within the partnership and/or financing agreements. It is important that the economics of the partnership are considered when appraising the fractional interest because simply multiplying the implied equity of the partnership by the ownership percentage would misstate value and not accurately capture the true economics of the project. In cases like these, a discounted cash flow method is generally required to model out the partnership’s distribution structure and forecasted cash flows to be distributed specifically to the subject interest over the expected holding period.

Above/below market debt

Another commonly overlooked complexity in appraising fractional interests in real estate is above/below market debt. This is particularly the case in the rising interest rate environment that we see today. As an illustrative example, we have three scenarios laid out below:

| Market | Hypothetical Debt Scenario #1 | Hypothetical Debt Scenario #2 | Hypothetical Debt Scenario #3 | |

| Loan to Value | 65.0% | 65.0% | 65.0% | 65.0% |

| Debt Service Coverage Ratio | 1.40 | 1.40 | 1.40 | 1.40 |

| Remaining Term/Amortization Period (Years) | 30 | 20 | 1 | 20 |

| Fixed Interest Rate | 7.0% | 4.0% | 4.0% | 9.0% |

| Unadjusted | Scenario #1 | Scenario #2 | Scenario #3 | |

| Property Value | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 |

| Mortgage Balance Outstanding | 500,000 | 500,000 | 500,000 | 500,000 |

| Fair Market Value of Mortgage (Illustrative) | 300,000 | 485,000 | 650,000 | |

| Fair Market Value of Equity | 500,000 | 700,000 | 515,000 | 350,000 |

| Mistatement Error | 200,000 | 15,000 | -150,000 | |

| Mistatement % | 40.0% | 3.0% | -30.0% |

In Scenario #1, the property is encumbered by a note that bears a 4.0% interest rate and has a remaining term of 20 years. The market interest rate as of the Valuation Date is 7.0%, substantially lower than the contractual rate of 4.0%. There is a significant benefit to the owners of the property over the remaining 20-year term due to this below-market rate, and the fair market value of the debt is likely substantially lower than the outstanding balance. Considering this in the valuation of an ownership interest in the property is extremely important as relying on the outstanding principal balance (rather than the fair market value) of the debt may misstate value and lead to a significantly lower value indication at the ownership interest level.

Scenario #2, on the other hand, similarly bears an interest rate well below market; however, the remaining term is only one year on the note. While it depends on the specific terms of the note agreement, any haircut to the fair market value of the debt resulting from the below-market rate over only a one-year term is likely small; however, consideration to this is still vital to a supportable valuation at the equity level.

Scenario #3 is less common in today’s market but reflects an instance where the contractual debt rate is above market for similarly risky properties and may imply that the fair market value of the debt is higher than the reported balance – lowering the implied value of equity.

Control and marketability provisions considerations

Another key consideration is the control and marketability provisions applicable to the interest. This is particularly important when considering any valuation discounts for lack of control or marketability. A few of the key provisions include the following:

- Control provisions: Can the subject interest…

- Control property’s day-to-day management?

- Control the timing/amount of cash distributions?

- Control the timing/amount of refinancings?

- Control the timing of property sale?

- Block refinancings or property sales?

Discounts for lack of control are recognized when the subject interest does not have the ability to control the management of its investment. The provisions above are some of the key considerations when determining the level of control a subject interest retains over a real estate investment. The amount of discount is often determined with a combination of these considerations and market data (e.g., Partnership Profiles Annual Minority Interest Database, which provides an indication on discounts based on re-sales of minority interests in real estate limited partnerships and non-listed REITs), with the selection based on the subject interest’s level of control relative to the underlying market data that is relied upon.

- Marketability provisions

- A right of first refusal

- Transfer without approval

- Transfer to a third party

- Mandelbaum factors:

- Prospective cash dividends to subject interest

- Prospects/timeline for liquidation or property sale

- Existence of potential buyers

- Contractual restrictions on transfer of subject interest (e.g., right of first refusal, inability to transfer to third party)

- Existence of any put rights

- Size of block of shares

- Access to information

Discounts for lack of marketability are recognized when the subject interest is not freely traded on an active market. It is a reduction in value associated with monetizing non-marketable assets, such as fractional interests in non-traded real estate limited partnerships. These discounts are typically quantified with restricted stock studies and protective put option models, and then selected based on the subject interest’s relative level of marketability (based on the factors noted above) compared to that underlying the market data.

The above are only a few of the key complexities often overlooked when performing fractional interest valuations in real estate properties. Independent, accredited appraisers are highly recommended when performing this work for gift and estate tax purposes in order to avoid overlooking complexities like these, and to provide adequate disclosure in the valuation report (and jumpstart the IRS’s statute of limitations). Contact your tax advisor for more information.

David Emma

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Poorly crafted purchase agreements and resulting erosion of deal value

Related services

Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.