Turn clean energy credits into cash through direct pay

Direct pay overview

As a participant in the clean energy economy, you may be able to turn your clean energy credits into cash through the elective payment election. The Inflation Reduction Act (IRA) of 2022 expanded numerous clean energy incentives and also created Section 6417 - Elective Payment of Applicable Credits, also known as direct pay. The IRS recently issued the long-awaited proposed regulations (REG- 101607-23) and issued temporary regulations under Section 1.6417-5T, which implement the pre-filing registration process and are identical to Section 1.6417-5 of the proposed regulations. The temporary regs require applicable entities and electing taxpayers to register with the IRS before they can make the direct payment election on their federal tax return. At its core, direct pay makes some clean energy credits refundable for applicable entities and eligible taxpayers. We will briefly review direct pay’s eligibility rules, eligible credits, electing and receiving payments, pre-filing registration, and additional rules for partnerships. Understanding and complying with the myriad of rules, deadlines, and documentation will be critical in turning your clean energy credits into cash.

Eligibility

Generally, direct pay allows exempt organizations and government entities to turn some clean energy credits into cash. These entities are classified as applicable entities. Since applicable entities typically do not have tax liabilities, these credits historically would go unused, but now they are refundable for cash. According to Section 6417, applicable entities include:

- Tax Exempt Orgs

- U.S. territories, states, local governments, and their agencies

- Indian Tribal Government

- Rural Electric Cooperatives

- The Tennessee Valley Authority

- Alaska Native Corporations

Any taxpayer that is not an applicable entity may elect to be treated as an applicable entity with respect to three types of applicable credit property: a qualified clean hydrogen production facility (Section 45V credit), a single process train at a qualified carbon oxide sequestration facility (Section 45Q credit), and eligible components qualifying for the advanced manufacturing production credit (Section 45X credit). After successfully making the election for the year in which the applicable credit property is placed in service, the electing taxpayer is treated as having made the election for the next four tax years as well, which means that they will receive direct payments for the first five tax years during the credit period of the applicable credit property. An electing taxpayer has a one-time option to revoke the election during those five years.

Eligible credits

By this point you are probably wondering: What are all the eligible credits? Here are the 12 credits that can be turned into cash by applicable entities, according to IRS Code, 6417(b):

- Section 30C Alternative fuel vehicle refueling property credit

- Section 45 Renewable electricity production credit

- Section 45Q Carbon oxide sequestration credit

- Section 45U Zero-emission nuclear power production credit

- Section 45V Clean hydrogen production credit

- Section 45W Qualified commercial clean vehicles credit

- Section 45X Advanced manufacturing production credit

- Section 45Y Clean electricity production credit

- Section 45Z Clean fuel production credit

- Section 48 Energy Credit

- Section 48C Qualified advanced energy project credit

- Section 48E Clean electricity investment credit

In order to be eligible for any tax credits, it’s important that the facility and its owners conform to all other rules in the law and regulations. Tax planning will be important to successfully realize your direct payment.

Electing and receiving direct payments

The first step in the direct pay process is to satisfy all the requirements of the applicable credits you plan to convert to cash. Then determine the tax year you expect to realize the direct pay. From this point you should complete the pre-filing registrations process (more on this below). Once these three steps are completed then the applicable entity or electing taxpayer can make the direct pay election on their annual tax return. Very generally, applicable entities and electing taxpayers make the direct pay election on their federal tax return where eligible credits are being realized. Please consider that there are special rules for electing taxpayers and then special rules for these electing taxpayers that are partnerships and S-Corps. There are also a few pitfalls that you should consider related to credit recapture, basis reductions, and excessive payment risk; penalties for noncompliance will likely apply.

Pre-filing registration

One of the steps in successfully making an elective payment election is completing the pre-filing registration process with the IRS. Rules for this process are provided in Proposed Reg. 1.6417-5, which is identical to Reg. 1.6417-5T. Before an elective payment election can be made, an applicable entity or electing taxpayer must register with the IRS, providing information regarding the entity that intends to make the election, the type of credit for which the election will be made, the credit property that will generate the credit, and other information. Upon making a successful registration application, the applicant will receive a registration number from the IRS for the applicable credit property, and this registration number will be used in making the election on the tax return. Pre-filing registration will be done electronically through a portal which will be set up by the IRS. More information about the process is expected by late 2023.

Additional rules for partnerships

A partnership can be an electing taxpayer and may make an elective payment election with respect to the three types of applicable credit property discussed above: a qualified clean hydrogen production facility (Section 45V credit), a single process train at a qualified carbon oxide sequestration facility (Section 45Q credit), and eligible components qualifying for the advanced manufacturing production credit (Section 45X credit). If a partnership owns and places in service such property, the election must be made by the partnership; it cannot be made by a partner. The payment is made to the partnership, which may then make a distribution to its partners, or use the payment in its operations. The credit amount is treated as tax exempt income, which is allocated to the partners in the same way the underlying credit would have been allocated.

Conclusion

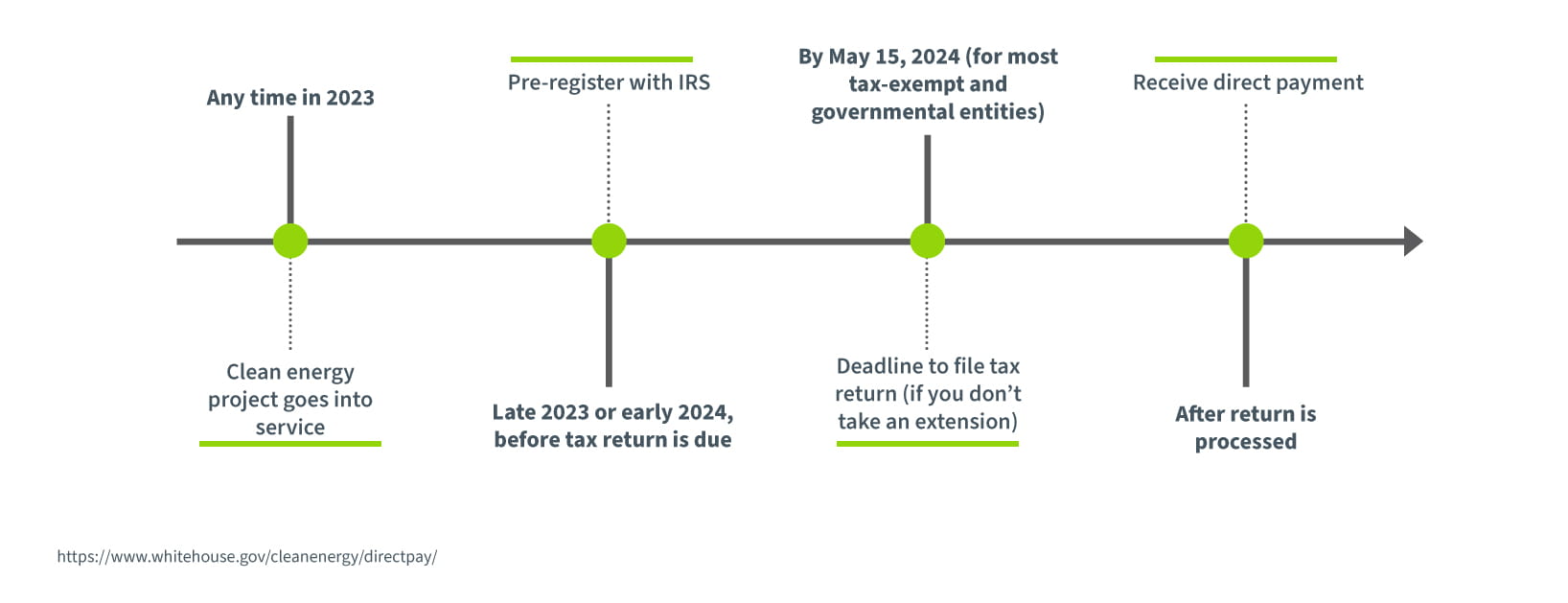

The direct pay provisions of Section 6417 create new ways for tax-exempt entities, states, local governments, and similar entities to participate in and benefit from tax credits generated by clean energy projects. Additionally, the rules allow electing taxpayers to receive direct payments for the Section 45V clean hydrogen production credit, the Section 45Q carbon oxide sequestration credit, and the Section 45X advanced manufacturing production credit, which opens the door to more and diverse tax structuring options for deals involving those three credits. Are you ready to monetize your clean energy credits? CohnReznick can help. We offer advisory services including tax structuring, project finance, and valuation to help you effectively monetize clean energy credits. We can also help with traditional tax compliance and assurance services. CohnReznick has a dedicated national team of multi-discipline consultants and CPAs ready to help you turn your clean energy credits into cash. Here's a sample timeline for claiming direct pay for most organizations with a calendar tax year*:

Contact

Matt Barnhill, CPA, Senior Manager, Value 360 – Project Finance & Consulting

704.900.1706

Jose E. Ponce, CPA, Senior Manager, Tax

916.930.5216

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

The Inflation Reduction Act

Related services

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.