Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Navigating uncertainty: A strategic financial framework for community health centers

Explore a strategic financial framework to help CHCs thrive amid instability. Learn how to adapt and lead through change.

The financial landscape for community health centers (CHCs) has entered a period of profound instability. The economic aftershocks of the COVID-19 pandemic continue to reverberate across the healthcare sector. CHCs are confronting a convergence of pressures – shrinking margins, rising costs, and shifting payer dynamics – that threaten their ability to deliver essential care to vulnerable populations.

In March, the National Association of Community Health Centers (NACHC) reported that nearly half of health centers are operating with unsustainable margins, and 42% are operating on 90 days of cash reserves or less.

As new healthcare policies reshape reimbursement, access, and care delivery models, CHC leadership must take decisive action and reexamine past decisions through a fresh lens – one that applies greater scrutiny to operations and services. Successfully navigating this evolving landscape demands agility, foresight, and a deep understanding of how regulatory shifts affect both sustainability and the broader value proposition of health centers. To survive and thrive, leaders must move beyond traditional visit-based metrics and embrace a patient-centered, data-driven approach to financial strategy. This article presents a comprehensive framework for understanding how we arrived at this pivotal moment and offers tools and strategies to guide CHCs forward.

Part I: How we got here – A retrospective through a new lens

Over the past 15 years, CHCs have faced a number of disruptors to their financial model. Healthcare reform and the advent of value-based care arrangements have caused health centers to modify work processes and staffing to meet the goals of value-based care through a myriad of payment models. Then, COVID-19 threw the healthcare industry for a loop, introducing telehealth, remote workforce, provider burnout, and continued workforce adjustments to meet the challenge. Now that it appears that the dust has settled, the “new normal” is alarming.

What’s driving this imbalance when we look at the period between 2019-2024?

- Service demand: Patient growth is still rebounding post-pandemic, and utilization of services (visits per patient) has declined by -4.8%, which can be a result of a multitude of factors.

- Rising costs: Whereas patients served has remained relatively flat, staffing levels increased by 19%, while provider productivity dropped significantly.

- Unchanged service mix: Despite higher costs and investments to expand services, the distribution of services per patient has remained largely static.

- Payer mix pressures: A shift from Medicaid patients to self-pay patients is generating operating losses per patient due to reductions in patient service revenue.

These trends underscore the need for a new financial model – one that shifts from a “visit-based” to a “per patient” perspective. As we know, patients are the driving force behind health center business. This model aligns with emerging capitation payment structures and enables CHCs to better understand the true cost and value of care delivery.

Part II: A new financial lens

To support this shift, CHCs should review information that translates financial statements and operating data into per-patient metrics. By analyzing trends in financial/operational metrics, health centers can identify areas where things may have gone awry and require attention. This new financial lens enables leadership to understand trends and identify areas by:

- Tracking operating margin per patient by payer source

- Analyzing cost drivers such as staffing ratios, service utilization, and overhead

- Benchmarking performance against state and national trends

For example, a Uniform Data System (UDS) roll-up analysis from 2019 to 2024 revealed that while the cost per patient rose by $520, the increase in NPSR was only $391. The gap was partially closed by other revenue sources, but the net margin per patient was $6.65 in 2019, which decreased to -$53.61 in 2024 (excludes capital and COVID-19 supplemental funding), indicating a negative -3.6% operating margin.

By applying this methodology at the individual patient level, leadership can identify specific areas of inefficiency and develop targeted strategies for improvement. In addition, evaluating patient cost and revenue metrics by payer, health centers are able to understand the impact future health benefit coverage changes may have on the center’s financial performance. CohnReznick has developed a tool that easily leverages a health center’s UDS so that the annual report is not just a reporting mechanism, but a strategic compass.

Part III: A strategic framework for sustainability and growth

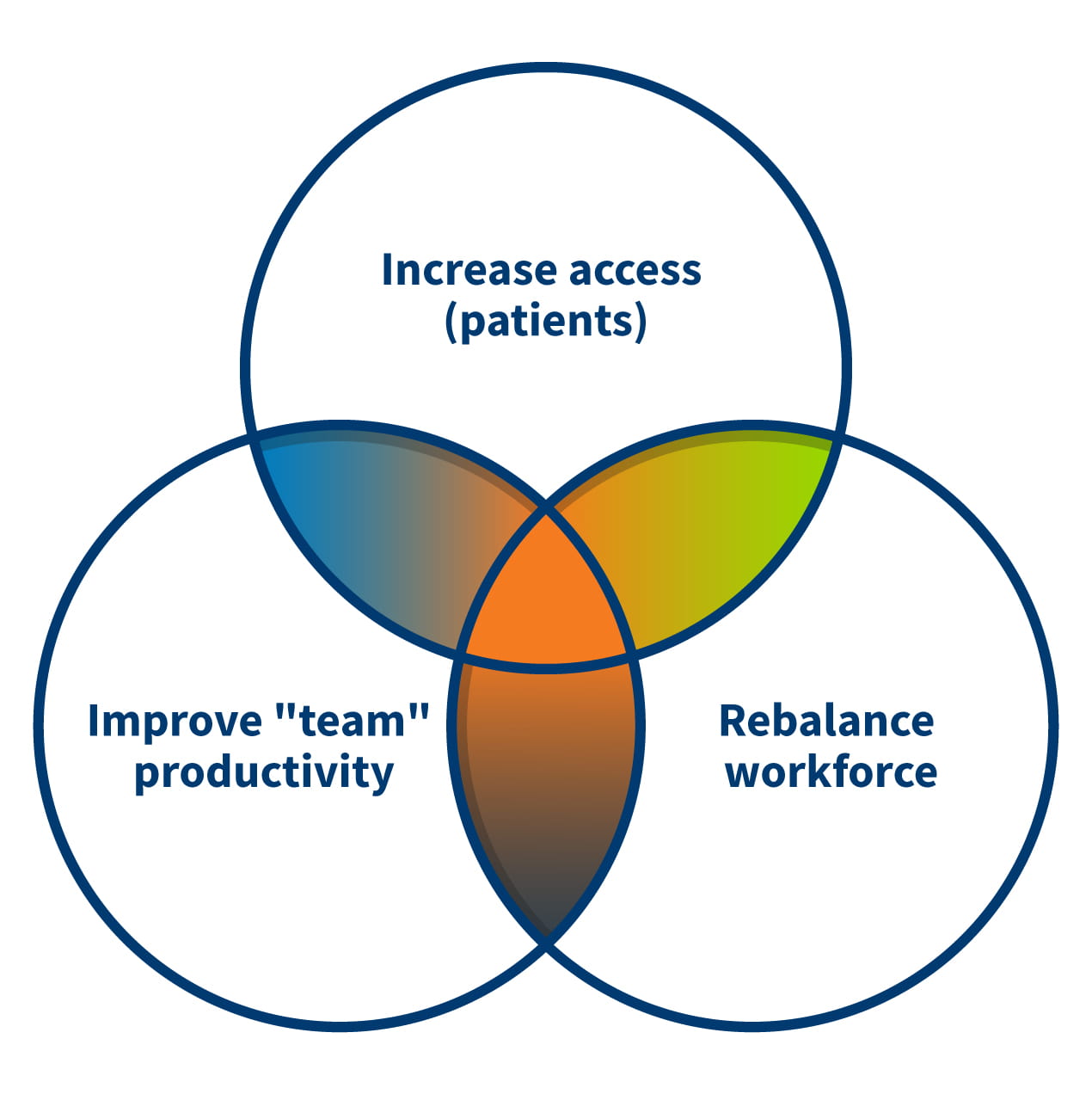

Given the current financial despair of health centers nationwide and impending Medicaid changes, there is no single solution for CHCs to right-size the ship. Health centers need to become nimble and reimagine themselves, refocus their business model around the patient. We believe the solution is a focus on patients, workforce, and productivity.

The Financial Assessment and Strategy Toolkit (FAST) is a gamechanger for CHC leadership. FAST provides a structured, data-driven framework for financial sustainability.

FAST includes:

1. 2019–2024 Financial operations analysis based on cost report or UDS data

- Variance analysis and scorecard of trends in revenue items, expense items, and utilization on a per-patient basis

- Benchmarking against statewide or national trends

- Confirming the contributing factors impacting positive and negative trends for your organization by metric

2. Strategic Action Plan

- Using 2024 as the baseline – identify strategic initiatives to redesign operations and services

- Identifies key performance indicators (KPIs) for improvement

- Includes prodding questions to guide department-level planning

3. High-level pro forma

- Based on the identified strategies under the Strategic Action Plan, projects the financial impact of proposed changes under various scenarios

4. Management report

- Tracks KPIs and financial performance over time, enabling continuous improvement

- To be used for internal communication with staff and board

FAST is more than a tool – it’s a process that can be done internally. It requires collaboration across finance, operations, and clinical teams. It demands transparency, accountability, and a willingness to challenge the status quo.

Part IV: Evaluation and monitoring – Building a culture of financial vigilance

Once the organization identifies operational changes that will improve their financial position, it’s imperative to evaluate the impact. At the core of a structured approach to financial evaluation and monitoring is a dashboard of KPIs that span financial, operational, and human resource domains. Here is a sample list of important KPIs:

Key financial KPIs:

- Operating margin per patient

- Days in unrestricted cash

- Days in working capital/reserve

- Debt service coverage ratio

- Cost per visit

- Net patient revenue per provider FTE

Operational KPIs:

- Team productivity

- Patient utilization rates by service type

- Staffing ratios

- No-show rates

- Collection rates by payer

HR and community engagement KPIs:

- Staff turnover and vacancy rates

- Time to first interview

- Website clicks and referral rates

These KPIs are not static – they must be monitored monthly and used to inform board-level decision-making. A deviation in any one metric can signal deeper systemic issues. For example, a drop in provider productivity may reflect burnout, staffing misalignment, or inefficient scheduling.

CohnReznick’s evaluation framework also includes a diagnostic tool that assesses cost per patient across five key drivers: service comprehensiveness, staffing profile, overhead, provider productivity, and salary levels. This granular analysis helps CHCs pinpoint the root causes of financial strain.

Part V: Consolidation, collaboration, and shared services

Building on this diagnostic insight, health centers are already translating financial analysis into strategic action. Confronted with growing economic pressures, many are reexamining their organizational models to strengthen sustainability and long-term resilience. These efforts have triggered a range of market adaptations which include consolidations and collaborative shared service arrangements that are reshaping the way health centers do business. In response to the evolving healthcare landscape, CHCs are increasingly pursuing structural reforms to stabilize finances and position themselves for future growth. The healthcare marketplace anticipates a wave of:

1. Mergers and acquisitions

- Full-asset mergers and asset acquisitions allow CHCs to expand services, increase market share, and achieve economies of scale.

- These transactions require careful due diligence, cultural alignment, and regulatory navigation.

2. Parent-subsidiary models

- These arrangements allow CHCs to “date” potential partners while limiting financial exposure.

3. Shared services

- CHCs are increasingly pooling resources for IT, HR, purchasing, and administrative functions.

- Benefits include cost savings, improved technology adoption, and enhanced talent acquisition.

These strategies are not just about survival – they are about positioning CHCs to thrive in a value-based care environment. However, they require robust financial modeling and a clear understanding of the business case.

In conclusion: Leading through the chaos

The road ahead for community health centers is undeniably challenging and currently requires flexibility under the new One Big Beautiful Bill Act. But within this chaos lies an opportunity: A chance to reimagine financial strategy, embrace innovation, and build more resilient organizations.

By adopting a per-patient financial lens, leveraging tools like FAST, and exploring collaborative models, CHC leaders can chart a path forward. This is not just about surviving the next fiscal year – it’s about securing the future of community-based care for generations to come.

The time to act is now to establish success for your organization.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.