Infrastructure Act awards: The benefits and potential pitfalls

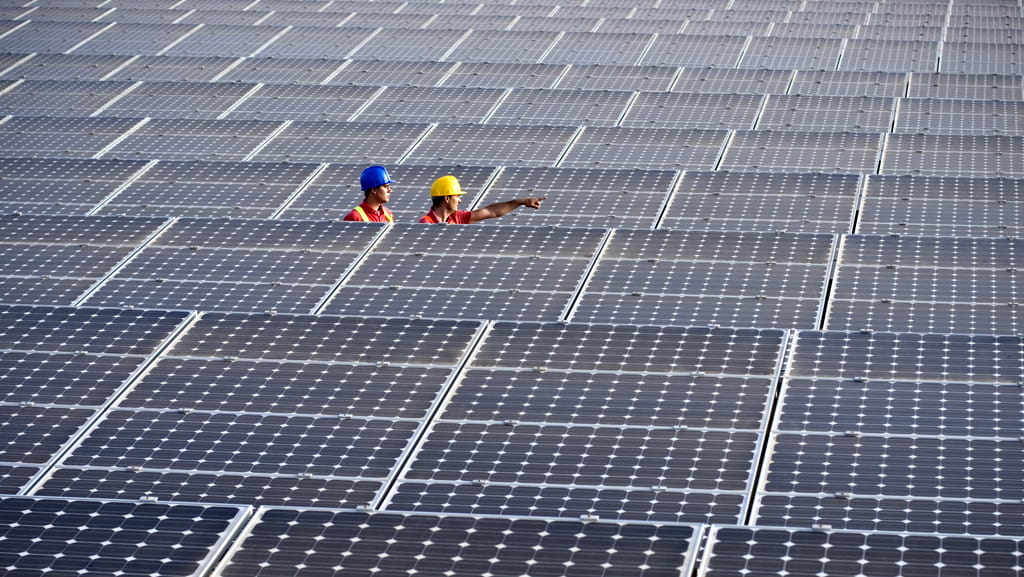

On Nov. 15, 2021, President Biden signed into law the Infrastructure Investment and Jobs Act, which provides billions in guaranteed funding for public transit projects and initiatives over the next five years (see chart for detailed funding breakdown). This bill is the largest federal investment in public transit in the history of the United States and provides funding across an array of initiatives. This act will award grants and federal procurement contracts with a major focus in the areas of manufacturing, construction, and clean energy.

Why would a company want to win a government award?

There are several reasons a company could benefit from proposing on and winning a government award. A major motivation is of course the financial benefits of a federal grant or procurement contract. The federal government is an extremely reliable payer and can quickly become one of your most consistent and reliable customers. Another reason a company could benefit from winning a federal award is that federal awards tend to be for longer periods of performance, leading to more regular, consistent revenue for your business. Winners of Infrastructure Act grants and federal procurement awards will generally fall into two categories: those that submit differentiated proposals which provide innovative and cost-effective infrastructure solutions to the government, and those that submit proposals that achieve the lowest price while still demonstrating a realistic technical approach. The federal government also makes it easy to identify new opportunities via SAM.gov and through the public announcement of the Infrastructure Act and the associated funding allotments. Further, the government includes opportunities specifically for small businesses and/or economically disadvantaged businesses that make it easier for companies of all shapes and sizes to participate in the bidding process of a federal award.

However, for many companies, the decision to pursue government contracts and grants can be significant due to the perception of the barriers to entry and lack of knowledge related to what it will take to succeed as a federal awardee.

Common pitfalls along the way to Infrastructure awards

Opportunities in the public sector environment, with its generally positive financial benefits and long-term reliable award vehicles, come with many administrative and regulatory challenges; even for experienced contractors. Ensuring that you have systems and processes to support quality performance are critical. Some common pitfalls we see from both new and experienced government contractors include:

- Inadequate policies and procedures: For business systems (i.e. accounting system for job costing, time, and expense tracking; estimating systems; purchasing systems; property management systems; earned value management system (EVMS); and material management system) if your practices and processes are not sufficiently documented then successfully performing on your government contracts becomes exceedingly difficult, particularly where contracts are covered by the DFARS business system criteria (DFARS 252.242-7005) and contractors are at risk of payment withholds if systems are not compliant.

- Poor records management: Government contractors are subject to increased scrutiny through audits and being able to demonstrate that all costs billed to the government were not only incurred but are also allowable, allocable, and reasonable is a requirement of your contract.

- Inadequate GAAP accounting and internal controls: Government contractors are required to operate in accordance with GAAP and federal procurement regulations, as applicable (i.e. FAR, CAS, DFARS, etc.). Those regulations require companies to have sound internal control environments in order to accumulate and bill costs on government contracts and grants. Single Audits and Program Specific Audits required under 2 CFR 200 will include an auditor’s opinion on the adequacy of internal controls as well.

- Inadequate processes for estimating in response to RFPs: Examples of this would include lacking a documented and consistent proposal process or reliable historical data for building bases of estimates, particularly for contract estimates requiring certified cost or pricing data.

- Lack of proper training: Individuals responsible for delivery and compliance, as well as all staff involved in the executing of and accounting for government project costs, must be adequately trained on the relevant government regulations and contract or grant requirements. Claiming unallowable costs on a government claim can result in not only the contractor having to pay back the government for those unallowable costs but also potential fines and penalties.

- Poor communication practices: An active and positive dialogue with your customer and auditors can go a long way when it comes to working with the government. An experienced team with frequent communication is essential for success, continuous improvement, and potentially winning future government work. Additionally, maintaining a positive and cooperative relationship with auditors is important for your business to demonstrate that costs claimed have been incurred and are allowable, allocable, and reasonable.

- Lack of a dedicated team and resources: Having the right resources at your disposal to design, implement, and maintain your government business approach is essential. Whether this is accomplished through in-house resources attained via effective hiring or outsourced partnerships with third party experts, it is crucial that you are staffing your team with the right people and resources to successfully perform on your government contracts.

Once you decide to jump into the federal sector, having the right in-house team and the right specialists on call is an excellent way to balance the cost of compliance and still get the right level of expertise needed to optimize your opportunities while remaining compliant with the many rules for federal contracts and grants. CohnReznick’s professionals have worked with a wide variety of clients to navigate entering the federal marketplace and are at the ready to assist your company to do the same.

Chase Clark

Senior Manager, Government Contracting

Close

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Receive CohnReznick insights and event invitations on topics relevant to your business and role.

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.