Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

PA House proposes expanding Film Tax Credit

Pennsylvania bill could boost film tax credits. Read more to see how your business might benefit.

Pennsylvania lawmakers have introduced a bill in their House of Representatives which if enacted would expand the scope of the existing film tax credit, increasing the credit’s annual cap from $100 million to $400 million and dramatically expanding the credit percentage.

H.B. 1775(Opens a new window) would make the most significant changes to the commonwealth’s film incentive program since it was created in 2016. Under the current program, a 25% base credit is available with a 5% additional credit (bump) for meeting certain minimum staging requirements. Under the proposed bill, the base credit for productions with qualified production expenses under $50 million would be increased to 30% while productions with over $50 million would receive a base 35% credit of their eligible expenses.

Additionally, the bill provides for three new bumps which are stackable and may be combined on top of the uplift for features and television shows meeting the minimum staging requirements:

- 5% if PA residents make up at least 60% of the cast and crew

- 5% if the official PA tourism logo is displayed in the end credits or promotional materials

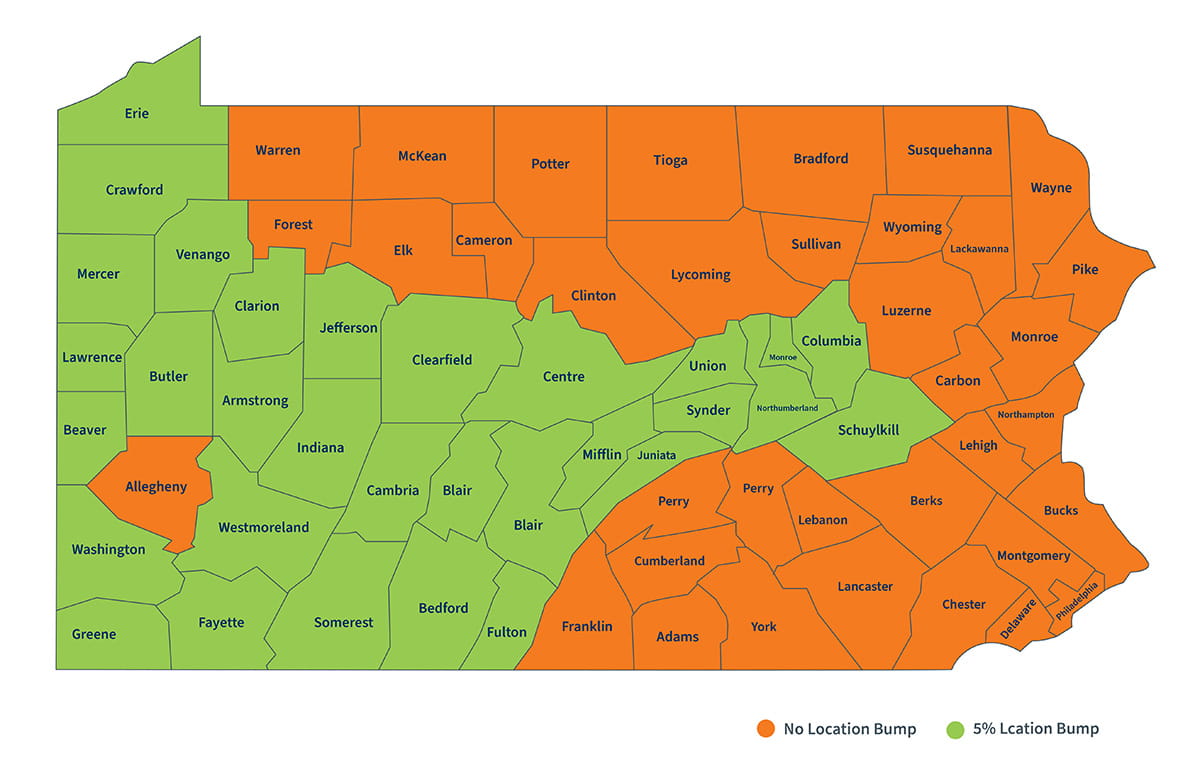

- 5% if the production is shot on location in any of 32 select counties(Opens a new window)

The location uplift targets the central and western portions of the state, with the notable exception of Allegheny County which is home to Pittsburgh. The bill doesn’t explain how the counties were selected and requests for comment from the offices of several of the bill’s sponsors were not received in time for publishing. In other states such as Louisiana, rural locations with lower historical production activity are targeted for this type of uplift. The bill as currently drafted does not specify how many days must be shot in the targeted counties for the bump to be obtained. The bill follows the current practice of allowing an uplift to generate the additional 5% credit on all of the qualified expenses of the production, not just those incurred in the select counties.

The bill would make certain other changes, such as disallowing double-dipping between the grant program under 12 PA C.S. S.4106 and the film production tax credit, and would allocate a credit reserve for smaller productions in the amount of at least $60 million for projects with budgets under $5 million spearheaded by Pennsylvania-based production and digital media companies, provided the projects have at least $150,000 in qualified expenditures. Incidentally, digital media companies would be defined as “a business that primarily creates, produces and distributes content in digital formats, consumed and accessed online or through digital devices.”

CohnReznick takeaway: Many state programs have struggled to adapt with how content is created and delivered today vs. how it was delivered when these film incentive programs launched. With this proposed bill, Pennsylvania appears to be trying to address the change from traditional feature film and television projects to today’s streaming and social media platform content.

The proposed increase in the total program size from $100 million to $400 million and concern of unused credits may have caused the bill’s authors to create a mechanism whereby unawarded credits may then be made available for use by taxpayers who are not Pennsylvania film producers or digital media companies.

One new feature the bill introduces is a $10 million retention credit pilot expansion for creative professionals, such as directors, animators, editors, post-supervisors and showrunners who commit to PA-based film, TV, digital media or streaming media projects for at least three years. This credit is capped at $150,000 per individual annually. At the same time, the Auditor General would be instructed to conduct an annual audit to verify compliance for anyone receiving this new credit. The credit earned could greatly exceed the individual’s tax liability and the credit would not be refundable and can’t be sold or transferred. Unused credits would roll over (up to three times) to the next year but would be reduced by the amount of credit claimed in the preceding year. Carrybacks would not be allowed.

CohnReznick takeaway: It may be difficult for creative professionals to take full advantage of this new program, however, as an individual tax credit is used to offset personal PA income tax liability.

The bill also has provisions for the Department of Economic Development to create a publicly available website to track credits issued and jobs created and economic benefits to PA as a result of the program.

CohnReznick takeaway: Traditionally, reporting on job creation and economic benefit to a state for such a program can be difficult to accomplish and is often fairly subjective.

What does CohnReznick think?

H.B. 1775 if passed would be a significant expansion of the film incentive program in Pennsylvania and would likely create a renewed interest by film and content creators over the coming years if the bill becomes law. Businesses involved in film, television, or digital content production should consult their tax advisor to understand how these updates could impact their planning, budgeting, and credit utilization strategies.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.