Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

New York State passes fiscal year 2025-2026 Budget

Key budget provisions include changes in personal income tax rates, partnership reporting requirements, and tax credit expansion for businesses.

Gov. Kathy Hochul recently signed into law the fiscal year 2025-2026 Budget Bill A/S3009C(Opens a new window) (the Budget) which focuses primarily on expanding opportunities for economic growth of small businesses through a variety of credit and incentive programs, and adjustments to various tax credits benefiting families and low-income homes within New York State.

Below is a summary of the Budget’s key provisions.

Personal income tax

Rate reductions

Income tax rates for each of the first five income brackets (up to $323,200 for Married Filing Jointly, and up to $215,400 for Single and Married Filing Separately) are reduced by 0.1% for tax years beginning in 2026 and further reduced by an additional 0.1% for tax years beginning in 2027. (See A/S3009C, Part B)

Extension of temporary surcharge

The temporary high-income surcharge, which was set to phase out beginning in 2027, has been extended to tax years beginning in 2032. The surcharge imposes rates of 10.3% on income between $5 million and $25 million and 10.9% on income above $25 million. (See A/S3009C, Part B)

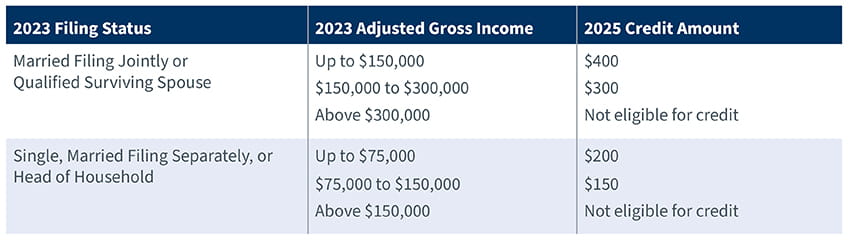

Inflation refund credit

Taxpayers who were full-year New York residents in 2023 and were not claimed as a dependent by another taxpayer will be allowed a credit if they meet income eligibility, as summarized in the table below.

The Department of Taxation and Finance will determine eligibility for the credit based on information from 2023 tax returns and will issue payments to eligible taxpayers. (See A/S3009C, Part A)

Partnerships

Reporting federal audit changes

Partnerships are required to report federal adjustments arising from partnership level audits or administrative adjustments even in instances where such adjustments result in an overpayment.

The partnership’s federal partnership representative is the New York partnership representative unless the partnership formally designates another person to act on its behalf. The authorized representative is the sole authority to act on behalf of the partnership and all direct and indirect partners are bound by the actions of the authorized partnership representative.

Impacted partnerships must file required reports with New York following a federal change and pay any New York tax due within 90 days of the issuance of the final federal determination. These reports are due within the 90-day window regardless of tax impact, and the updated reports must include the impacted partnership’s direct and indirect partner information for review. (See A/S3009C, Part V)

Creation and expansion of tax credit programs for businesses

Semiconductor Research and Development Tax Credit

Taxpayers that have been approved by the commissioner of economic development to participate in the semiconductor research and development program and have been issued a certificate of tax credit will be allowed to claim a tax credit for qualified investments in semiconductor research and development programs occurring within New York.

The credit is up to 15% of the cost of the qualified investment and may be claimed for up to 10 years. (See A/S3009C, Part H)

Semiconductor Manufacturing Workforce Training Incentive Program Tax Credit

Taxpayers that have been approved by the commissioner of economic development to participate in the semiconductor manufacturing workforce training program and have been issued a certificate of tax credit will be allowed to claim a tax credit for costs associated with hiring and training employees.

The credit is equal to 75% of the wages, salaries, or other qualifying compensation, training costs, and wraparound services up to $25,000 per employee receiving eligible training. The maximum amount of credit available to a qualifying taxpayer is $1 million per business. The credit can be carried forward to future tax years if not fully utilized in the first year of approval. (See A/S3009C, Part H)

Empire State Independent Film Production Credit

Qualifying independent film production companies may claim a credit equal to 30% of the qualified production costs paid or incurred in the production of a qualified film.

In addition, those companies may claim a credit equal to 10% of the qualifying wages, salaries, or other compensation paid to certain employees.

Definitions and detailed eligibility criteria are provided in new Tax Law Section 24-d. (See A/S3009C, Part I)

Credit for rehabilitation of historic properties

The Budget provides broader eligibility for properties that are considered affordable housing projects.

Additionally, credits are now transferrable to another person or entity through a new credit transfer process with the approval of the Office of Parks, Recreation and Historic Preservation. (See A/S3009C, Part E)

Metropolitan Commuter Transportation Mobility Tax (MCTMT)

The MCTMT has been eliminated for qualifying self-employed individuals earning up to $150,000 starting with the 2026 tax year.

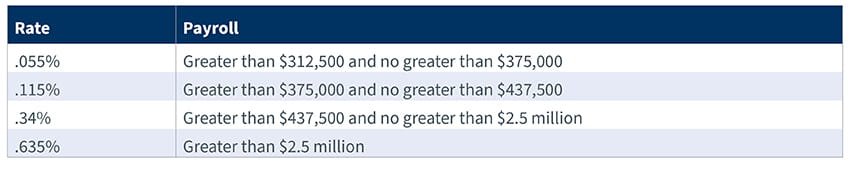

In addition, the rates have increased for qualifying taxpayers based on their zone. Zone One includes Bronx, Kings, New York, Queens, and Richmond counties. Zone Two is comprised of Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester counties.

While the individual rates in these zones will not change, effective Jan. 1, 2026, the threshold for paying tax will increase from $50,000 to $150,000.

The employer rates for Zone One, however, will be changing. Effective July 1, 2025, the employer rates for Zone One are:

What does CohnReznick think?

Taxpayers doing business in New York should be mindful of the changes effectuated with the enactment of the Budget. There could be opportunities through the various credit expansions available to taxpayers. Partnerships should consult with their advisors whenever there is a federal change to help ensure compliance with New York State’s new federal change provisions. In addition to the items listed above, the Budget contains numerous other state and local provisions which could impact your business. If you are interested in how any of these provisions may impact you, please reach out to your tax advisor.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.