Manufacturing & Distribution M&A Report: 1H 2025

Explore top M&D deals, OBBB tax incentives, tariff risks, and food and beverage trends shaping the first half of 2025’s M&A landscape.

All data gathered from PitchBook Data, Inc., as of July 15, 2025

While 2025 began more cautiously than anticipated, deal momentum in the manufacturing and distribution (M&D) industry has not disappeared. Strategic acquisitions — including several headline-making transactions — are still moving forward, with debt financing continuing to play a meaningful, if more measured, role in 2025 like it did in 2024.

During the first half of 2025, several notable deals closed:

$24.7 billion

Beery Global, a supplier of plastic packaging products, was acquired by Amcor (NYS: AMCR) for $24.7 billion in April.

$14 billion

$6.7 billion

$6.5 billion

OpenAI acquired Io Products for $6.5 billion, expanding its portfolio of AI-enabled, screenless smart devices powered by tools like ChatGPT.

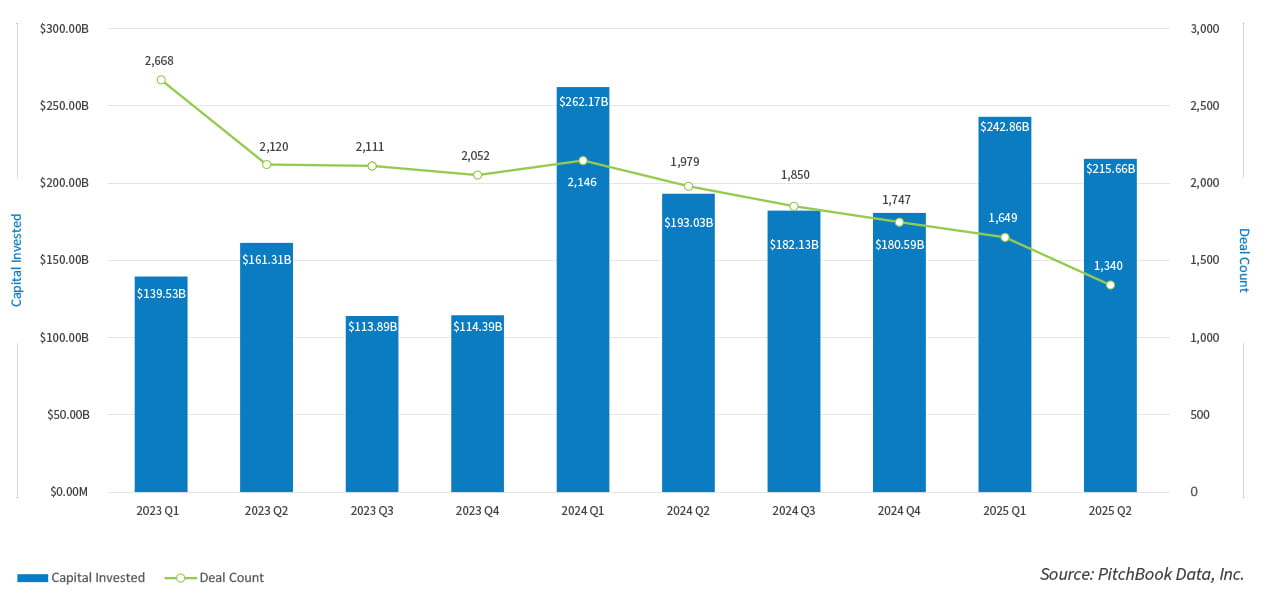

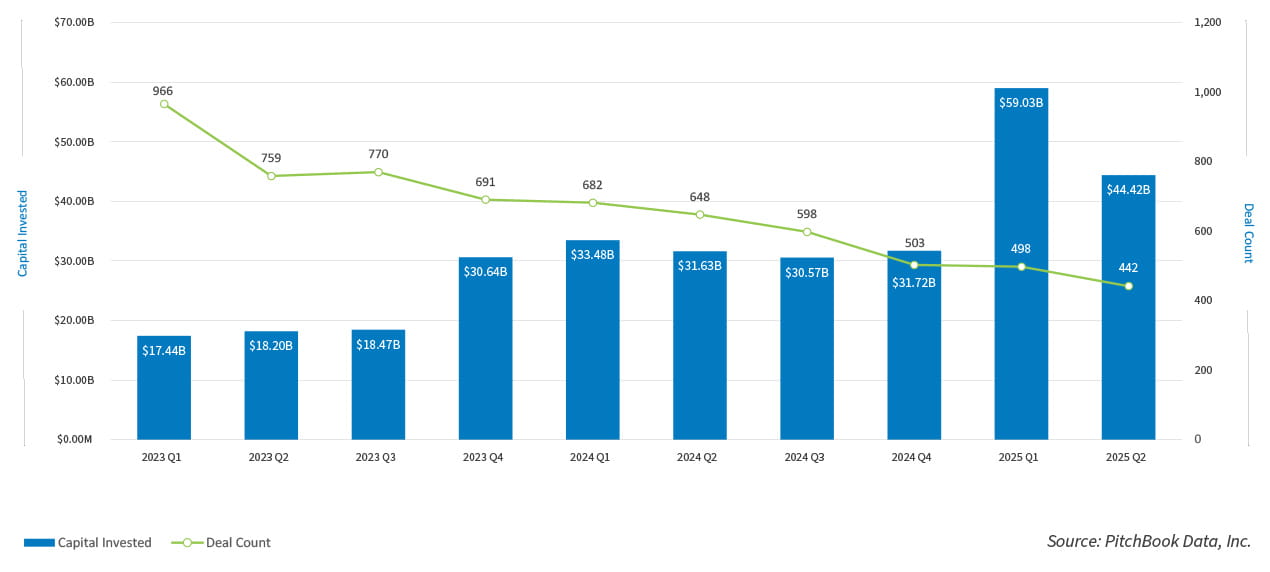

M&D Capital Invested & Deal Count

Deal volume in 1H 2025 totaled

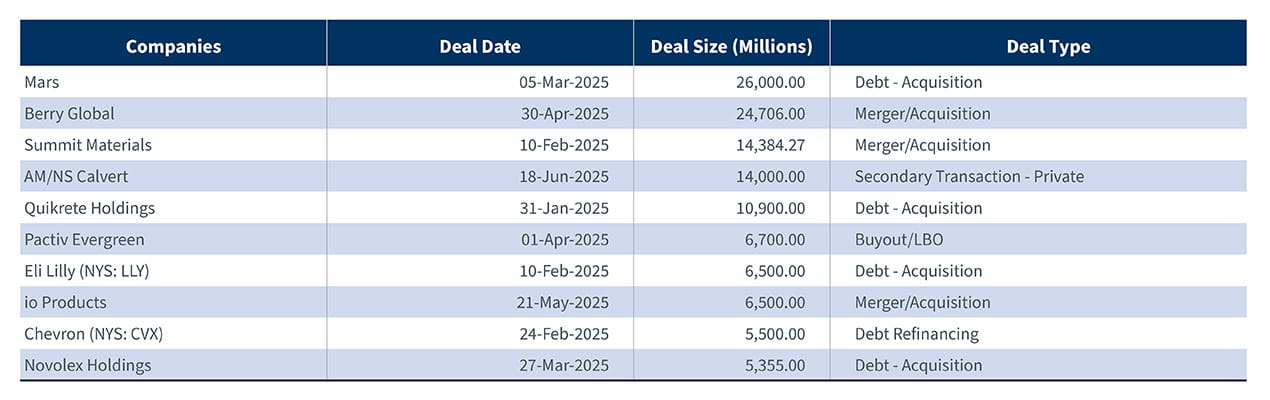

Top 10 M&D deals

Among the top 10 M&D deals that closed, only four were debt refinancings, but two — Mars ($26 billion) and Quikrete Holdings ($10.9 billion) — had outsized influence on market trends. Other significant debt transactions included Eli Lilly ($6.5 billion) and Novolex Holdings ($5.4 billion).

Private equity remained active, with familiar names like Apollo Asset Management, Bain Capital, and Blackstone leading in deal volume. New entrants to the top investor list included Barings with $442 billion AUM and CFT Capital Management, LLC, a Los Angeles–based family office managing $3.4 billion. Venture capitalists re-entered the market in late 2024 and, specific to 2025, we noted Morrison Seger, Tonic Ventures, General Catalyst, and SOSV active in the market.

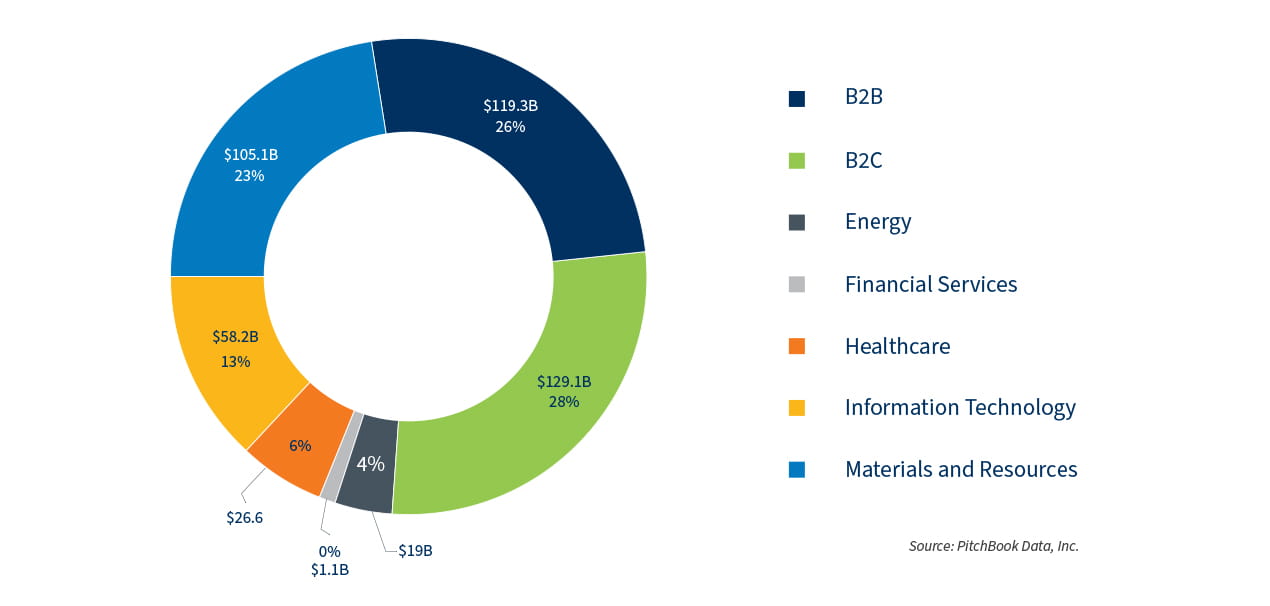

Capital invested by primary industry sector

From a sector perspective

Market factors impacting M&A

With inflation and interest rates coming down from the prior year, the focus has shifted for most businesses and investors to the One Big Beautiful Bill (OBBB) Act(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) and tariffs. OBBB is an extensive bill to review, so we have summarized the key areas from the Bill that will impact manufacturers and distributors:

- Qualified Production Property (QPP): New 100% bonus depreciation for U.S.-based manufacturing non-residential real estate under Section 168(n) incentivizes domestic facility investment. This includes buildings used in manufacturing, refining, or production activities where construction begins after Jan. 19, 2025, and before Jan. 1, 2029. More guidance is expected from the IRS/Treasury soon.

- R&D Expensing: Full expensing of domestic R&D costs and optional amortization provide flexibility and cash flow advantages beginning after Dec. 31, 2024.

- Section 179 Expansion: The increased expensing cap supports capital-intensive upgrades and equipment purchases beginning after Dec. 31, 2024.

- Interest Deduction Planning: Section 163(j) permanently allows depreciation and amortization add-backs in ATI calculations beginning after Dec. 31, 2024, but would exclude subpart F, GILTI inclusions, and Section 78 gross-ups beginning after Dec. 31, 2025. Interest capitalization and ordering rules are confirmed to be effective Jan. 1, 2026; manufacturers and distributors should consider interest capitalization projects for 2024 and 2025 tax returns.

- Advanced Manufacturing Credit: Increased from 25% to 35% for post-2025 investments under from 25% to 35% for post-2025 investments under section 48D.

- Section 45X Phase-Out: The advanced manufacturing production credit begins phasing out in 2030 and ends by 2033, with new restrictions on specified foreign entities and foreign-influenced entities.

There are many caveats to the deductions above and we recommend a business fully understand the guidance before taking any actions with the expectation to utilize the tax benefits. Make sure you review additional insights(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) on the OBBB and its impact on both businesses and individuals.

As it relates to tariffs, businesses must remain agile as there remain continuous changes in the affected countries and products, the applicable percentages, and the parties impacted (importer vs. exporter). Recent executive actions are focused on reciprocal tariffs for multiple countries — ranging from 25% to 40% depending on the origin and product category. Additional proposals are also under consideration, signaling potential shifts in trade dynamics that could impact M&D supply chains. For manufacturers navigating this uncertainty, proactive planning and practical strategies(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) are a must.

We recommend that businesses take the following actions:

- Evaluate their outlook to understand the locations of their suppliers

- Determine which price increases can be passed along to customers

- Assess inventory levels in relation to current demand and forecasts, and consider the feasibility of stocking large quantities of inventory before the tariffs take effect (if still able to do so)

- Maintain timely and frequent communication with suppliers and customers to navigate the impact across the entire supply chain

Risk Quantification Tariff Risk Impact Model (RQ TRIM)

Food and beverage M&A activity

The food and beverage manufacturing sector has been a consistently active segment within M&D. In the first half of 2025, the larger deal activity was comprised of debt refinancings.

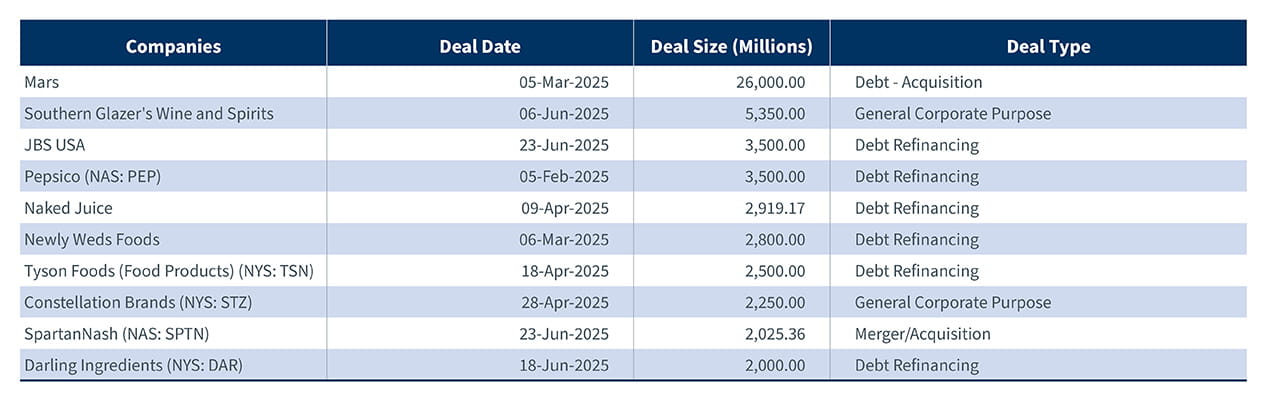

top 10 F&B deals

Notable transactions during this period included the following:

- Mars raised $26 billion in debt financing. The funds will be used for acquisition purposes. You may recall Mars announced its acquisition of Kellanova last year for $36 billion. As of this article, the deal has not yet closed, but it received U.S. antitrust approval for the transaction in June 2025, and is now waiting on the EU, which opened an investigation of the transaction.

- Southern Glazer’s Wine and Spirits raised $5.35 billion of debt financing in June 2025 to support general business activity of the alcoholic beverage distributor.

- Naked Juice completed $2.9 billion debt refinancing in April 2025. The company who produces juices and fruit smoothies is aiming to enhance its liquidity and improve the company’s capital structure.

f&B capital invested & deal count

The 1H 2025 overall deal activity in the food and beverage sector had 940 transactions totaling $103.4 billion in capital deployed. This compares to 1,330 deals and $65.1 billion invested during the same period in 2024. Despite the lower deal count, the average deal size rose significantly — reaching $110.1 million in 1H 2025 versus $48.9 million in 1H 2024 — mirroring the broader trend across the M&D space. Even when excluding the $26 billion Mars debt refinancing, the average deal size remains elevated at $82.6 million, underscoring the continued appetite for larger, more strategic investments.

Venture capital continues to lead the number of capital investments in the food and beverage industry during 1H 2025, with prominent investors such as Morrison Seger, Anti Fund, Feenix Venture Partners, and Melitas Ventures. However, private equity firms and family offices also made some notable investments during the same period and include firms like Tonic Ventures, Shore Capital Partners, HC Private Investments, and Bain Capital.

Key food and beverage trends to watch

Halfway through the year, we've seen a number of interesting new trends taking shape in the food and beverage space – new flavors and formats, new iterations of the familiar, and more. We'll be watching these standouts we've discovered through interactions with our network, coverage(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) of the semi-annual highlight Specialty Food Association's Summer Fancy Food Show, Expo West, and other sources across the industry.

- Maple takes center stage: With the global maple syrup market valued at $1.7 billion(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) and climbing steadily, it’s no shock that maple was the breakout flavor this year. Think: maple-infused waffles, cheeses, butters, sauces, and yes, sparkling maple water.

- Spices that steal the spotlight: Spices and herbs are simmering toward a $52 billion market(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) by 2025, and "everything spice" is leading the charge. Once exclusive to bagels, it's now coating soft cheeses, crackers, and even candied pecans. Flavors from India are also taking the stage this year, expanding beyond curry dishes into snacks and sauces including crunch chickpea puffs and BBQ sauces.

- Carbs, but make them smart: Runners and snackers alike found plenty of options at the show — crepes, waffles, bagels — remixed with no-sugar-added ingredients, real fruit, and smart carbs with protein and fiber. Noodles and chips got a healthy upgrade too, proving comfort food can be conscious.

- Beverage innovation overflowing: With the non-alcoholic beverage market projected(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) to hit $1.4 trillion by 2025 and 7.5% Compound Annual Growth Rate (CAGR) through 2034, brands are shaking things up with flavor-forward, health-first sips. The large market size is not a surprise as there continues to be an increase in health-conscious consumers who are demanding sugar-free and functional drinks. So how do beverages stand out? By 1) being creative with flavors such as Bollygood’s sparkling lemon pomegranate cardamom beverage, 2) offering only real food ingredients and no sugars in sodas as done by Fresh Fizz Sodas, or 3) adding probiotics and adaptogens to non-alcoholic beverages as launched by Ginny this year.

What’s next?

Despite ongoing uncertainties surrounding evolving tariff situations, the OBBB has delivered substantial positive news for manufacturers and distributors, presenting opportunities for significant cost savings. In July 2025, the U.S. labor market added 73,000 jobs and unemployment rate rose to 4.2%, revealing a slowdown in job growth. Interest rates have decreased compared to the previous year, with anticipation of another rate cut in the coming year. The Consumer Price Index (CPI) increased 0.3% on a seasonally adjusted basis in June after rising 0.1% in May and 2.7% over the last 12 months, according to the U.S. Bureau of Labor Statistics report(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) issued on July 15, 2015. However, it is lower than the CPI of 3% for the 12-month period that ended in June 2024. Similarly, the Producer Price Index (PPI) was up 2.3% year-over-year in June 2025, which is better than the 2.7% reported in June 2024 for year-over-year.

These macroeconomic factors are critical considerations for investors when making transaction decisions. Many investment bankers, private equity firms, and advisors remain optimistic that the second half of 2025 will be more active than the first half. According to Brookfield Asset Management, there is an estimated $150 trillion in global assets under management across all asset types as of 2025, indicating a substantial amount of capital available for investment activities. We’ve already heard a great start to 2H 2025 with the announcement of Ferrero acquiring WK Kellogg Co. for $3.1 billion(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window), a strategic move that will give Ferrero control over the manufacturing, marketing, and distribution of Kellogg’s breakfast cereals.

As we move into the second half of 2025, the M&D M&A landscape remains dynamic, shaped by a mix of macroeconomic tailwinds, evolving trade policies, and legislative developments like the OBBB. While uncertainty around tariffs, global supply chains, and an unpredictable labor market continue to challenge decision-making, lower interest rates and favorable tax incentives are creating a more supportive environment for dealmaking. With significant capital still on the sidelines and early signs of renewed momentum, the outlook for the remainder of the year is cautiously optimistic. Manufacturers and distributors that stay agile, informed, and proactive will be best positioned to capitalize on emerging opportunities and navigate the complexities ahead.

Looking to maximize value in your next deal? Contact our team(Opens a new window)(Opens a new window)(Opens a new window)(Opens a new window) today for help navigating M&A complexity with confidence.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.