Navigating the new retail staffing landscape

It is well understood that employee turnover is a massive issue in retail. By some accounts, turnover rates among frontline workers is at least 60% annually, and approximately 63% of retail managers are thinking about quitting in the near future(Opens a new window). And while retail employee turnover is not a new issue, social, technological, and macroeconomic developments over the past three years have made retail staffing even more challenging. The pandemic directly affected consumer preferences – both what we buy and how we buy it. The continued expansion of omni-channel capabilities and technologies have unlocked new ways of interacting with customers. Inflation, increased competition, and low unemployment rates have applied significant pricing and cost pressures. Amidst these factors, management has had to keep a watchful eye on profit margins, a part of which is reducing employee churn by providing an environment that meets the ever-evolving needs and wants of its employees. That’s an awful lot of plate-spinning.

Further complicating retail staffing, both the type and quality of employees you need to remain competitive in this dynamic environment is changing too. As retail customers are seeking a seamless online and in-person experience, retail operating models have had to adapt to that reality. President of West Elm, Jim Brett, said recently, “I think brick-and-mortar is an amazing opportunity to use our stores and our store staff as a vehicle to truly engage with the community.” Said differently, while e-commerce has forever changed how we shop, retailers have been forced to reconsider the highest and best use of their brick-and-mortar operations, and, in many cases, the staffing models used to support those operations.

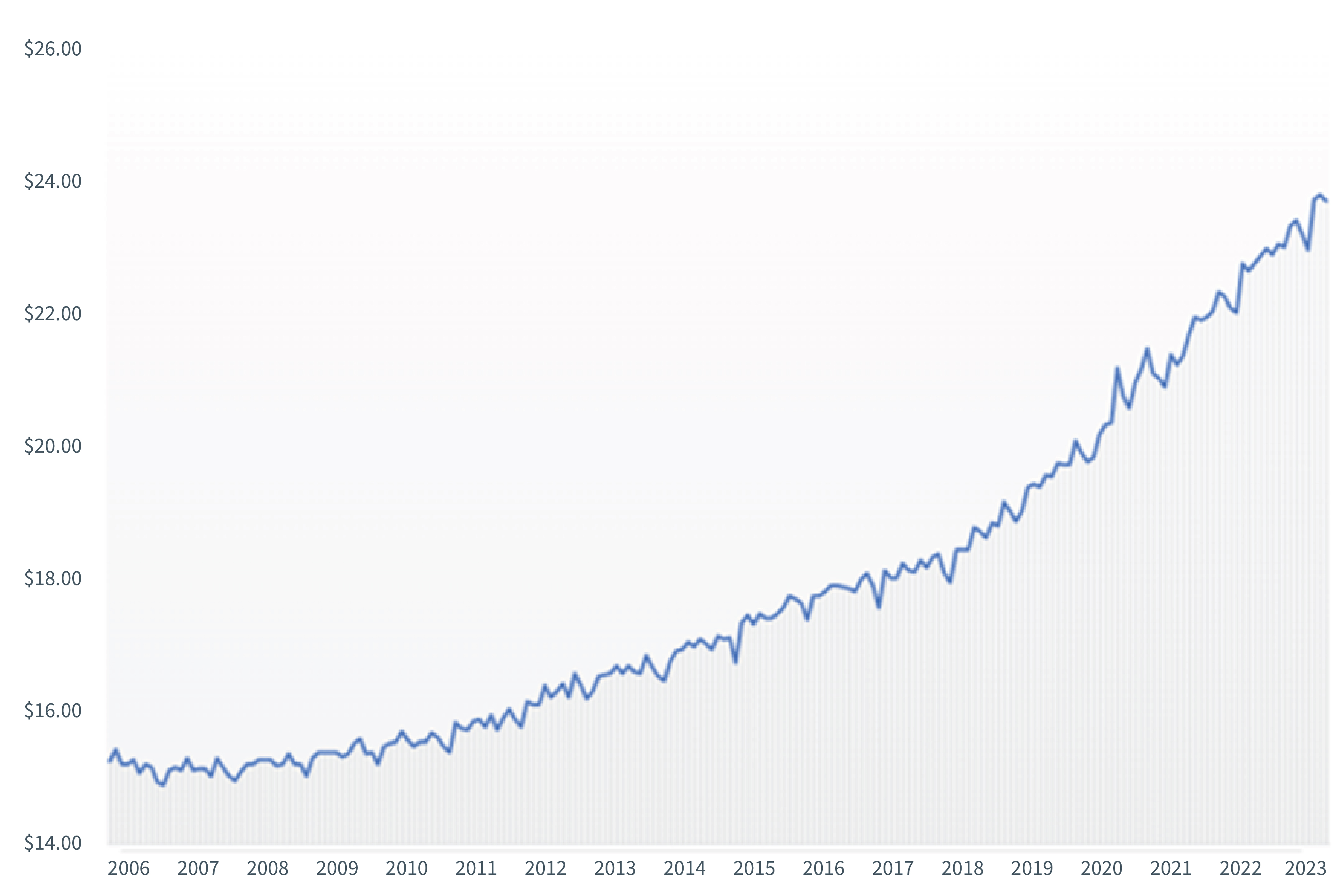

If all of this sounds expensive, you’re right. In fact, per Federal Reserve Economic Data, annual retail wage growth rate from 2006 to 2019 was 1.86%. Since 2019, that rate has nearly tripled to 4.93%. Competition for the right kind of retail workers is driving up labor costs in an unprecedented fashion.

Average Hourly Earnings of All Employees, Retail Trade, Dollars per Hour,

Monthly, Not Seasonally Adjusted

First, get serious about data and invoke the Drucker

As the founding father of modern management studies(Opens a new window), Peter Drucker famously said(Opens a new window), “There is nothing so useless as doing efficiently that which should not be done at all.” In this context, it’s important to think about your retail operating model so that you’re working to incentivize and retain the right employees based on how you must now sell to, and service, customers.

1. Given the events of the past few years, do you still understand both what your customers want and how they want to shop with you?

By way of a simple example, the pandemic allowed work-from-home employees to work in more comfortable clothing. As a result, apparel, and footwear trends during the main years of the pandemic reflected higher demand for clothing in those categories. Sales of athleisure were up; suits and high heels were down. Not surprisingly, with the current return-to-office trend, employees are now updating their wardrobes with more formal office attire but are not necessarily willing to give up that comfort to which they’ve become accustomed. If these trends are not well-understood, a retailer will suboptimize product assortments, ultimately resulting in discounts that erode margins.

Furthermore, the pandemic shifted how we all shop. A heavier reliance on e-commerce, delivery, and reverse logistics meant lower inventories at brick-and-mortar locations. Are your customers coming back to the store, or are they looking for new ways of interacting with your brick-and-mortar locations?

The notion of “listening to your customer” may sound routine but taking a moment right now to re-examine the who, what, when, where, why, and how are reflected in your current sales and service practices is a worthwhile exercise. Key data points to consider when taking this deep dive; buying trends, inventories, sell-through data, keen knowledge of your competition, and customer satisfaction surveys.

These can all act as rich clues that can help you refine complete, end-to-end customer sales and service journeys and ultimately understand how they can inform your current staffing model. Measure and adjust.

2. Do you know where your retail associates currently spend their time? Are all those activities adding value to the customer experience?

If the answer is “no” to either of those questions, it’s time to rethink both your staffing models and the way you service your customers. There are a host of analytical tools and technologies that can help drive meaningful insights into what kind, how many, and when retail associates are needed. In a perfect world, you have exactly the right number and type of retail workers available at the right time to match customer demand.

Second, get smart on incentives

Once you’re satisfied that you’ve got the ideal customer-focused retail operating model that makes the highest and best use of required retail employees, then:

- Understand your employee’s wants and needs - Recognize that it may not always be about money. Some may want flexibility, paid time off, better/different benefits, continuing education, career progression, employee discounts, or other incentives. Can you offer a flexible basket of incentives that can be tailored to the individual?

- Consider the adoption of technology to solicit employee feedback - Introduce shorter, more frequent employee touchpoints. Make it easy to both ask for feedback on your cadence, and for your employees to offer feedback on theirs.

- Establish and socialize KPIs - KPIs, such as the Employee Net Promoter Score (eNPS), are simple and effective measurements of employee satisfaction that you can benchmark, track, and, most importantly, take action on. Resist the urge to over-measure; balance the need for a long list of eSat metrics with your desire to maintain them.

- Understand total cost of turnover - Your total cost of turnover includes costs of employee disengagement, recruiting, training, productivity, loss of customer intimacy, and institutional knowledge. All of these costs should be considered when setting wages. Another way of thinking about this is: What’s the full economic value of a good retail employee? Similarities in regard to the high cost of turnover exist for retail companies as they do the restaurant industry. In this recent article we outlined a few additional strategies for reducing labor costs that could be applied to the consumer sector as well.

- Align incentives - People behave the way they’re incentivized to behave. Depending on the sales, profitability, and/or customer experience targets you’re driving towards, aligning employee incentives to goals reflected in top-level organizational strategy is a win-win.

- Focus on culture - Today’s Gen Z workforce is demanding that your business mission align with their values while offering work-life balance. Be genuine and vocal about the business goals and your company culture. Create an environment that is inclusive, diverse, and compassionate at all levels. Consider partnering with a local community organization that aligns with your company’s mission to increase your recruitment talent pool.

When done correctly, putting these two main practices into place can help retailers increase service levels, employ a motivated workforce, reduce operating costs, and, most importantly, become more competitive in the fight for labor.

Related services

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.