Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Leveraging a green bank’s balance sheet to develop more socioeconomic projects

Understand the primary mechanisms through which green banks can leverage their capital base to mobilize resources, finance projects, and address key developmental challenges.

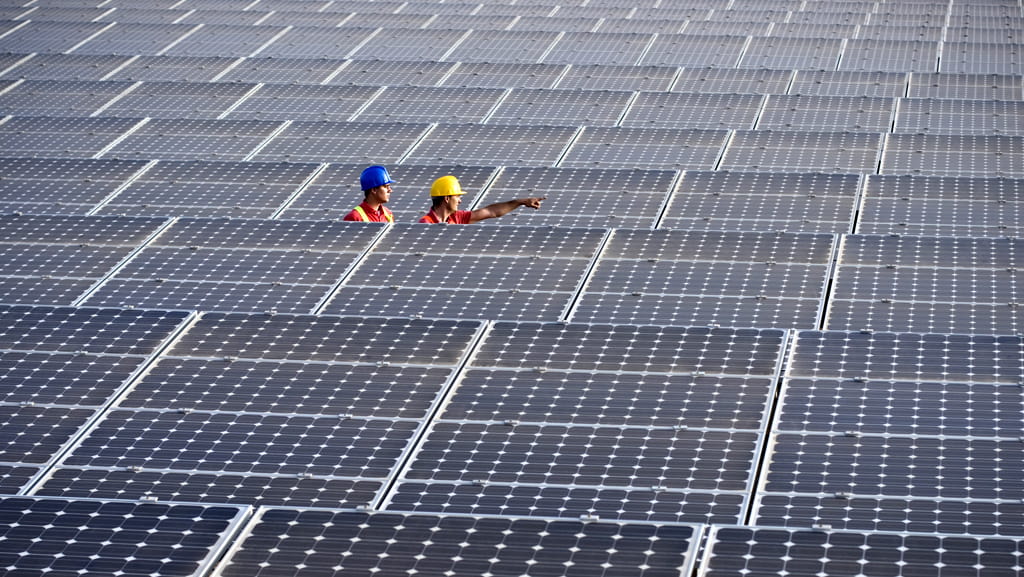

State “green banks” will play a crucial role in advancing decarbonization efforts, promoting economic growth, and fostering sustainable development throughout the U.S. Central to their operations is the ability to leverage monies they will be receiving as a subrecipient through the Greenhouse Gas Reduction Fund’s National Clean Investment Fund, Solar For All program, and Clean Communities Investment Accelerator. In order to better promote these sustainable decarbonization projects, green banks will need to successfully leverage their balance sheets. To achieve this, understanding the primary mechanisms through which green banks can leverage their capital base to mobilize resources, finance projects, and address key developmental challenges is crucial. These include leveraging capital, credit enhancement, pooling resources, and innovative financing mechanisms.

Leveraging capital

Green banks can leverage their balance sheets primarily by mobilizing capital from various sources, including the U.S. government, non-governmental organizations (NGOs), capital markets, and other financial institutions. Green banks often operate with a capital structure that allows them to obtain or raise funds at preferential rates thanks to their socio-economic mandates and perceived lower risk profiles. By leveraging their capital, green banks can significantly increase the overall monies flowing to projects and amplify the impact of their investments. They can also give more weight to the socio-economic benefits of an investment than a traditional bank and can ascribe value to these benefits. As a result, green banks do not need to have the same cash on cash return requirements that traditional banks require and, therefore, will be able to allocate more capital to projects with innovative technologies or that do not have the years of operations that traditional banks typically like to see.

Loan portfolio recycling

In addition to fueling economic activity by providing funds for individuals, projects, and companies to invest, spend, and grow, when borrowers repay their loans with interest, a green bank will recycle these funds by issuing new loans and perpetuating the cycle of lending and economic expansion. Green banks will also engage in secondary market transactions where their loans are bought and sold to further facilitate the recycling process. Through securitizations, green banks will bundle a group of loans into securities, which are then sold to investors. This practice not only frees up capital to issue new loans but also allows these banks to mitigate risk by diversifying and shaping their loan portfolios. By recycling loans through these mechanisms, green banks play a crucial role in allocating capital efficiently while driving their socio-economic mandates.

Credit enhancement

One of the key strategies green banks can employ to leverage their balance sheets is credit enhancement. This involves providing guarantees (full credit and/or targeted), or insurance to projects or loans. By providing credit enhancement to projects, the overall risk assumed by investors and lenders is lowered, and by assuming a portion of the risk, green banks enable projects to access financing on more favorable terms, including lower interest rates and longer tenors. This mechanism not only facilitates project implementation but also attracts private sector participation in development initiatives. The green banks will charge a premium for the credit enhancement they provide but the overall cost of funding for the project will be lower.

Pooling resources

Green banks will collaborate with other similar types of institutions, state governments, and private sector entities to pool resources and co-finance projects. Through syndicated lending, co-investment platforms, and joint ventures, these entities can collectively leverage their balance sheets to support larger-scale projects that may be beyond the capacity of any single organization. Pooling resources also fosters knowledge sharing, promotes best practices, and enhances the overall effectiveness of these various sources of funding.

Innovative financing instruments

To further leverage their balance sheets, green banks are increasingly turning to innovative financing instruments. These include green bonds, social impact bonds, and blended finance mechanisms, which combine concessional and commercial funding to address complex environmental and social challenges. By tapping into and availing themselves of new financial instruments and markets, green banks can attract additional investment capital, particularly from institutional investors seeking both financial returns and positive social and/or environmental outcomes.

Risk management

Effective risk management is essential for green banks to use these tools and leverage their balance sheets prudently. Green banks need to employ rigorous risk assessment methodologies, diversify their portfolios across sectors and regions, and implement robust monitoring and evaluation systems to mitigate potential losses. By maintaining sound financial health and credibility, green banks enhance their ability to raise capital and attract investment, thereby maximizing their social impact.

A final word on balance sheets

The ability of green banks to leverage their balance sheets is fundamental to their mission of promoting sustainable decarbonization projects in the U.S. Through capital mobilization, credit enhancement, resource pooling, innovative financing, and risk management strategies, these institutions amplify their impact, catalyze investment, and facilitate transformative change. As challenges such as climate change, inequality, and housing crises continue to evolve, the effective leveraging of balance sheets by green banks will remain critical in addressing these pressing issues.

How CohnReznick can help

CohnReznick has broad capabilities, experience, and contacts to help green banks further their missions. We have assisted our green bank clients with a broad array of services and bring industry expertise from across our firm for each engagement. These services include:

- Application Support

- Project Finance and Consulting

- Financial Modeling and Vetting

- Loan Due Diligence and Underwriting

- Debt and Capital Markets Structuring and Negotiating

- Credit Enhancement Structures and Products

CohnReznick provides forward-thinking services to many clients in the decarbonization, renewable energy, and community development industries.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.