Why businesses should act now

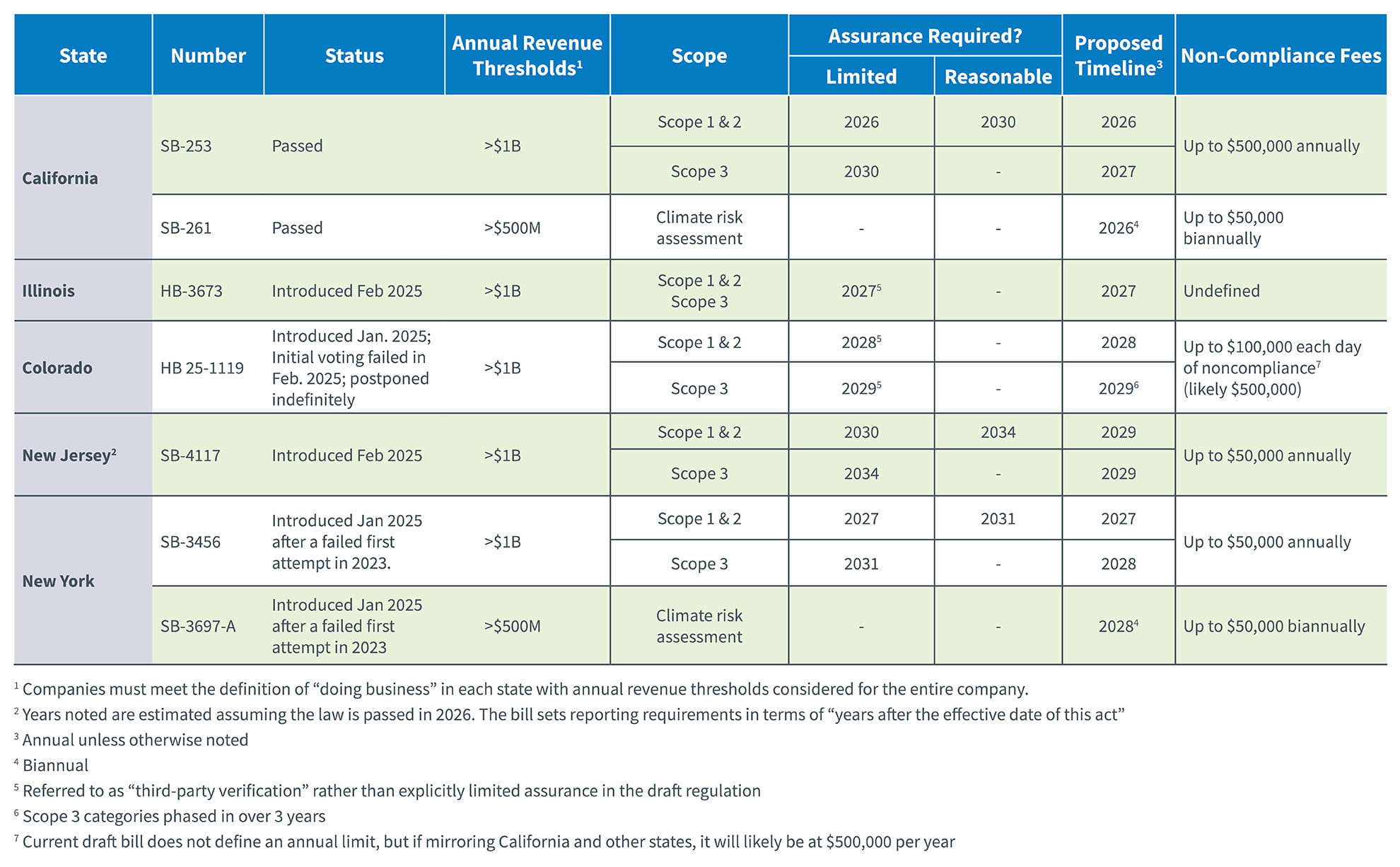

Even if your company isn’t currently in scope for California’s climate disclosure laws, the national trend is unmistakable: climate reporting is becoming a standard business expectation, not just a regulatory requirement. Companies that wait to act risk falling behind in compliance, investor trust, operational readiness, and competitive positioning.

Preparing for climate disclosure is not a quick task. A climate risk assessment can take up to four months, while a Scope 1 and 2 GHG emissions inventory with limited assurance may require six months or more to complete. These timelines reflect the complexity of data collection, validation, and assurance, and demonstrate that last-minute compliance can be both costly and risky. For multinational businesses, the urgency is even greater. The convergence of global standards – including the EU’s Corporate Sustainability Reporting Directive (CSRD), the UK’s TCFD-aligned rules, Australia’s Sustainability Reporting Standard aligned with the International Sustainability Standards Board (ISSB), and Canada’s proposed climate disclosures – means that climate transparency is quickly becoming embedded in financial and operational reporting worldwide.

The benefits of proactive management of regulatory risks include:

- Avoiding future penalties by preparing early

- Building investor confidence through transparency

- Strengthening operational resilience against climate risks

- Streamlining overlapping state mandates that may emerge

How CohnReznick can help

Navigating climate disclosure regulations requires more than just awareness. It demands a strategic, well-resourced response. CohnReznick’s Sustainability Advisory practice is here to support companies at every stage of their compliance journey.

Our California Compliance Readiness Assessment is a quick, five-minute tool designed to help companies:

- Determine if they’re in scope for California’s climate laws

- Identify gaps in current reporting capabilities

- Receive tailored recommendations for next steps

Our support doesn’t stop there. We offer:

- GHG emissions inventory development for Scope 1, 2, and 3

- Climate risk assessment and scenario analysis aligned with SB-261 and global frameworks like TCFD and IFRS

- Assurance readiness and third-party verification support

- Cross-state compliance strategy to prepare for overlapping mandates

- Stakeholder engagement and reporting advisory to align disclosures with investors and public expectations

Whether your company is already in scope or approaching the thresholds, our team can help you build a roadmap that turns compliance into a competitive advantage.

Readiness is key

California may have led the way, but the momentum is building elsewhere too. Climate disclosure laws are expanding across the U.S., and the regulatory landscape is evolving quickly. Whether your company is in scope today or nearing the thresholds, the time to act is now.