Receive CohnReznick insights and event invitations on topics relevant to your business and role.

Revenue Recognition - Commencing Conversion and Implementing New Processes

New Revenue Recognition Accounting Standard

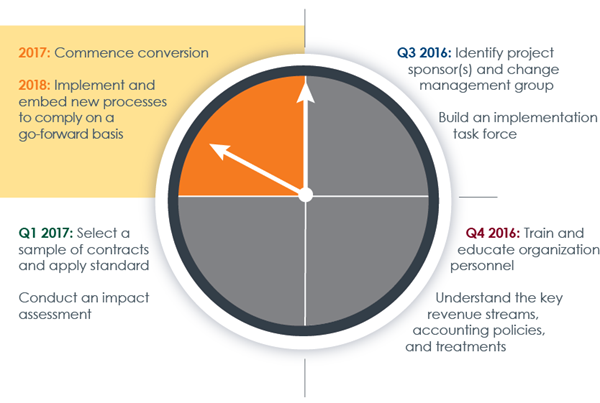

Part 4 of 4:In the final installment of CohnReznick’s four-part informational series aimed at helping companies prepare for the new revenue recognition standard, we discuss steps 7 and 8 of the transition timeline, which we recommend commencing in 2017. Steps 7 and 8 focus on starting the conversion and making changes to the processes, systems, and controls that are likely to be needed in order to comply with the new standard on a go-forward basis.

Step 7: Commence Conversion

Once all of the groundwork (i.e., steps 1 – 7 of the transition timeline) has been laid, conversion can begin. At this point, the company should determine which adoption method (i.e., full retrospective approach or modified retrospective approach) it will proceed with if this was not addressed at the outset of the project. From here, the company will map all of the accounting policy differences noted during the impact assessment and begin to establish new policies and processes sufficient to address those gaps while also dealing with various systems impacts.

At this time, the company should also consider a “dual-GAAP approach.” By monitoring the impacts to revenue recognition the task force and other members of the implementation team will be better prepared to inform key stakeholders of the types of reporting differences the adoption of the new standard is having in real time. The results of the dual-GAAP approach should be discussed with the company’s external auditors as well as across functions within the organization.

Step 8: Implement and Embed New Processes to Comply on a Go-Forward Basis

In this final step, the organization will set about institutionalizing its new compliance processes, collecting and converting data in accordance with the new standard on a going-forward basis. The company should test any new processes and controls (both manual and systems-based) that result from the conversion process to ensure both the accuracy and reliability of the new revenue information. Management should begin drafting the new enhanced disclosure requirements while ensuring data capture is sufficient to comply with all aspects of the new standard. Management should also consider the needs for disclosure during its transition efforts as well as from a going-forward perspective.

Because the new standard has implications for the organization’s people, processes, and systems, the compliance program needs to be comprehensive in order to ensure that the new standard is appropriately applied on a go-forward basis. When developing the compliance program, consider the following:

People

• The work of the cross-functional implementation team should continue for some time after the initial conversion

• Update training on new revenue recognition policies, procedures, and tools (if applicable)

• Establish new key controls over revenue recognition and ensure proper segregation of duties

• Review possible revisions to compensation arrangements

Processes

• Several business processes may be directly impacted upon adoption of the new standard, including:

◦ Financial close process

◦ Financial reporting, including disclosure processes

◦ Income taxes

◦ Contract creation

◦ Revenue allocations

◦ Compensation / employee commissions

◦ Budgeting and forecasting

• Processes related to internal audit and Sarbanes-Oxley certification may need to be modified ◦New review and approval processes

◦ New key controls

Data

• Design new solutions (or rebuild current systems) to support the new revenue recognition principles

• Ensure that contract terms and conditions and sales order processes are effectively integrated to ensure proper recording of revenues

• Determine new data elements that will allow for more effective and efficient recording of revenues for specific rules

◦ Need to allow for certain flexibility in cases where judgment may be involved

• Establish appropriate revenue allocation rules, where appropriate

• Connect systems

• Automate processes

Reporting

The financial reporting processes are perhaps the most important processes likely to be impacted by the adoption of the new standard. In particular, the following areas of both internal (i.e., management) and external financial reporting will likely to involve a certain level of change:

• Updated executive-level dashboards, management reports, and performance metrics

• Ability to provide meaningful detailed data on revenue-related information, when needed

• New disclosure requirements – both quantitative and qualitative

Policies

The development of new accounting and other business policies will likely begin as soon as the transition process gets underway. Key policy considerations include:

• Transition approach: Full retrospective vs. modified retrospective approach

• Guidance with respect to applying judgment to the following:

◦ Collectability

◦ Multi-element contracts

◦ Variable compensation

• Established materiality thresholds

• Streamlining contracting policies ◦Contract standardization

◦ Guidance regarding side letters and / or subsequent contract modifications

Clearly, implementation of the new standard is a considerable undertaking. With the clock ticking on the deadline for adoption, it is imperative companies take a pragmatic approach to capitalize on the time remaining and make sure they are fully prepared.

Stay Informed

CohnReznick is committed to providing the tools and information CFOs and financial executives need to successfully lead their organizations in the implementation process. To receive the latest updates and industry-specific information, bookmark our revenue recognition resource webpage and look for announcements of upcoming webinars.

Return to Revenue Recognition Series page.