Here’s a high-level summary about how these changes will impact your business.

- The final regulations remove the provision that allows minimum sample size to be the lesser of 20% of the total number of low-income units or the minimum sample size set forth in the Low-Income Housing Credit Minimum Unit Sample Size Reference Chart, based on HUD Real Estate Assessment Center (REAC) protocol.

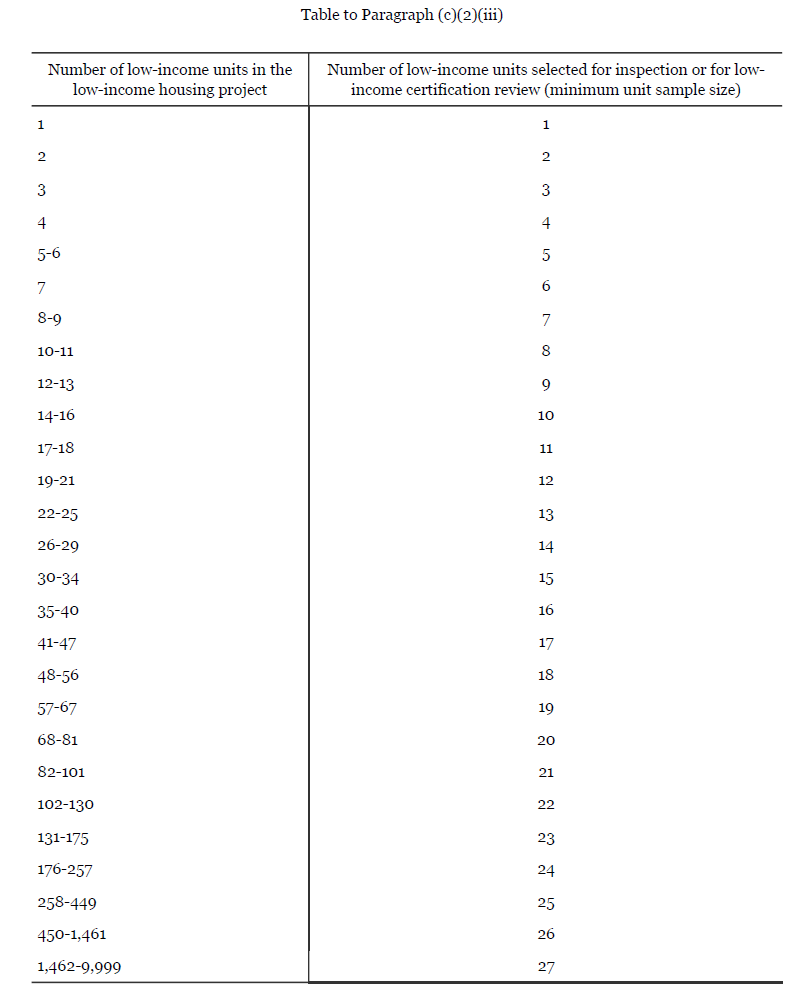

- Sample sizes for physical inspections and review of low-income certifications will now only be based on the minimum sample size set forth in the attached chart based on REAC protocol. For smaller projects containing 100 or fewer units, the elimination of the 20% option will increase number of units selected. Agencies have discretion to increase the number of units selected.

- Agencies are still required to physically inspect “all buildings” unless a project inspection is conducted under REAC protocol. If randomly selected units don’t cover all buildings, then the agency may inspect some aspect of the building like the exterior, common areas, or HVAC.

- The reasonable notice requirement is shortened from 30 to 15 days with notice of specific low-income units identified for certification or physical inspection to occur only on the day of inspection. Agencies are required to randomly and separately select units for inspection and certifications for review, by choosing at least the minimum number of units in each case.

- Agencies are required to amend their qualified allocation plans (QAP) to reflect the final regulations by Dec. 31, 2020. IRS Revenue Procedure 2016-15 is obsolete with respect to an agency at the earlier date on which the Agency’s QAP is amended to reflect these final regulations or Dec. 31, 2020.

Beth Mullen

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

CohnReznick’s Affordable Housing Industry Practice

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick LLP, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.